Buy LIC Money Back Policy online

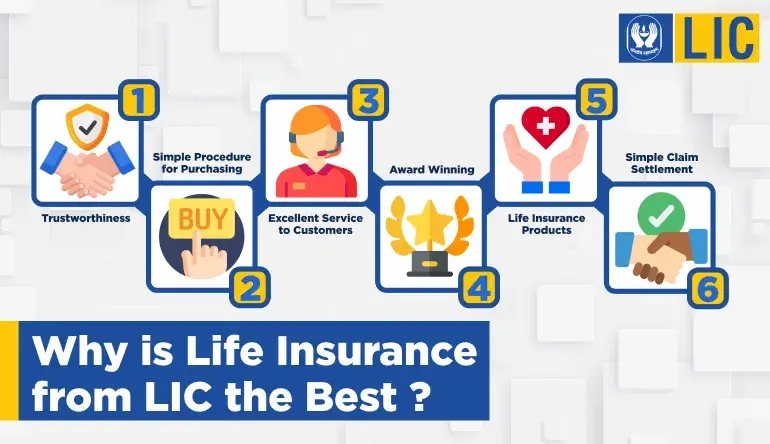

For Indians, LIC Money Back policies are a popular option for attaining various financial objectives, including safeguarding their children’s education and marriage as well as planning for a comfortable retirement. These policies not only provide valuable life coverage throughout the policy duration, but they also carry important tax advantages under Section 80C of the Income Tax Act. This enables policyholders to decrease their taxable income by investing up to Rs.1.5 lakh. A notable advantage of LIC Money Back policies is the ability to purchase them online. Opting to buy these policies through online platforms offers a seamless and user-friendly experience, simplifying the process of securing your family’s financial future from the convenience of your own home.

LIC Money Back plans have a unique feature where policyholders receive regular payments. These plans function like traditional endowment assurance LIC Tax Saving Plan policies as they provide guaranteed payments at specific intervals throughout the policy’s duration. The amount paid is a percentage of the sum assured, ensuring that policyholders have access to liquid funds periodically. This aspect of Money Back plans makes them a great choice for individuals who value financial stability and prefer a steady income during important stages of life.

Among the various options available in LIC Money Back policies buy lic money back policy online , the LIC Money Back Plan – 20 years is particularly popular for meeting medium-term financial goals. For those with longer-term financial objectives, there is also the LIC Money Back Plan – 25 years. Both these plans give peace of mind to individuals by offering life coverage along with the guarantee of regular returns, including significant bonuses upon survival or maturity.

To summarize, LIC Money Back policies provide a complete option for Indian policyholders who want to safeguard their family’s future, enjoy tax advantages, and guarantee financial stability with consistent payments. Whether you choose the LIC Money Back Plan – 20 years best money back policy or the LIC Money Back Plan – 25 years lic’s new money back plan 25 years , these policies can be conveniently purchased online and serve as a dependable method to fulfill your financial goals.