The LIC Money Back Plan 20 Years is a comprehensive financial solution offered by LIC, the largest insurance company in India. This plan is specifically designed to provide periodic payouts to policyholders, ensuring a regular flow of income, and also offering a substantial amount of life cover.

The LIC Money Back Plan is a non-linked participating policy that not only fulfills your financial goals but also provides protection to you and your loved ones. With a policy term of 20 years, this plan offers policyholders the flexibility of paying premiums for a shorter duration, while enjoying the benefits for a longer span of time.

With advancements in science and technology, average life expectancy rates have been increasing in India over the years. Because of this, it has become more important than ever to plan for a longer, happy, and peaceful retirement in order to maintain financial independence. To live these moments to the fullest you need to have assurance of a life cover to protect your loved ones in case of any uncertainties and also plan for various life goals like marriage, parenthood, children’s education and any unforeseen emergencies for which you would need a financial plan that gives you the reassurance of a guarantee.

Under this plan, policyholders receive a certain percentage of the sum assured as guaranteed survival benefits at regular intervals. These guaranteed survival benefits act as a financial cushion, providing policyholders with liquidity at different life stages. Additionally, on survival until the end of the policy term, the policyholder receives the balance of the sum assured along with the accrued bonuses.

“If a Child, a Spouse or a Parent depends on you and your income, you need Life insurance”

The LIC Money Back Plan 20 Years is ideal for individuals who seek a combination of insurance protection and financial stability, making it an excellent choice for long-term financial planning.

| Minimum age | 13 years (Completed) |

| Maximum age | 50 years |

| Maximum maturity age | 70 years |

| Minimum Sum Assured | Rs.1,00,000 |

| Maximum Sum Assured | No limit |

| Policy Term | 20 years |

| Premium paying term | 15 years |

| Premium payment | Yearly / Half yearly / Quarterly / Monthly (ECS) |

| Loan | Eligible after 2nd year |

| Surrender | Eligible after 2nd year |

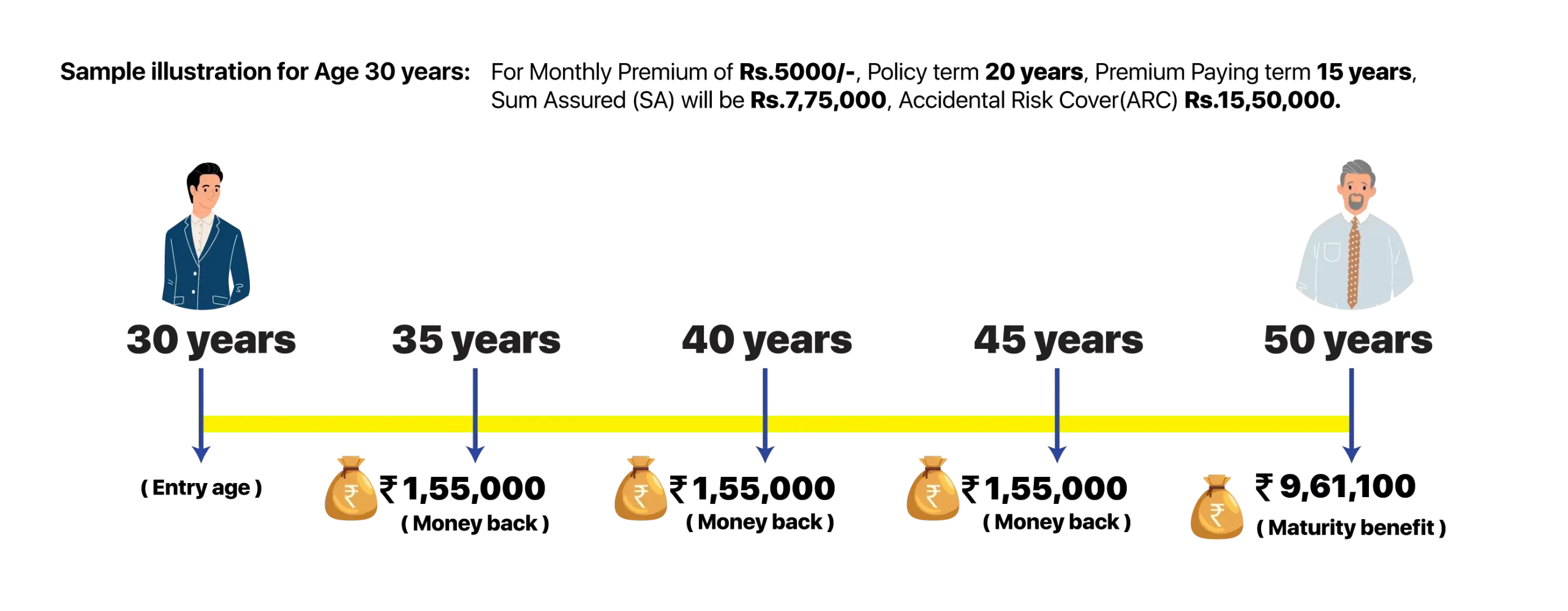

| Money Back is paid | End of 5th year - 20% of Sum Assured End of 10th year - 20% of Sum Assured End of 15th year - 20% of Sum Assured |

| On Maturity | 40% of Sum Assured + Bonus |

| On Death | 125% of Sum Assured + Bonus (Money back already paid will not be recovered) |

| Income Tax Benefits | (i) Premiums paid are eligible for Tax rebate u/s 80c (ii) Maturity amount / Death claim is non-taxable u/s 10(10d) |

LIC Money Back Policy 20 years Benefits

LIC Money Back Policy 20 years Benefits In the event of the policy holder’s demise within the policy tenure the Sum Assured on Death along with the accrued Bonuses would be payable to the nominee regardless of the amounts paid earlier as the survival benefit.

The Sum Assured on Death is higher of the following:

The survival benefits in this plan wherein if the policyholder survives the policy tenure and if all premiums have been accordingly paid, then a fixed percentage of the overall sum assured amount will be awarded to the policyholder as follows:

A total amount equivalent to 60% of the sum assured is paid as survival benefits.

Maturity benefit is payable on survival of the life assured through the entire Policy Term of 20 years, then the balance of 40% of the sum assured along with accrued simple reversionary bonuses and final additional bonus will be paid as the maturity benefit and the policy terminates.

LIC’s New Money Back Plan (20 Years) LIC Best Money Back Plan also comes with a Surrender Value feature under which a particular percentage of the Premium Amount is given back to the insured in case the policy holder decides to surrender the policy after completion of 3 policy years.

A policyholder is eligible for a loan if 3 years the full premium amount is paid, followed by the policy acquiring a surrender value.

As a policyholder the participant, you are entitled to the profits of the insurance company by way of eligible for Simple Reversionary Bonus and Final Additional Bonus as declared by LIC and will be paid at the time of Maturity of the policy or as the death benefit.

The premiums paid towards buying LIC New Money Back Plan (20 Years) is considered as a tax-free deduction under Section 80C of the Income Tax Act. One can claim a maximum deduction of INR 1.5 lakhs on this amount. The section 10 (10D) of the Income Tax Act allows us to put all the benefits received including death and maturity benefits

Life cover during the policy term: If the death of policyholder occurs during the policy term, the nominee will receive the Sum Assured on Death plus simple reversionary bonuses and final additional bonus declared.

The Sum assured on death is 125% of the Basic Sum Assured or 10 times the annual premium paid as on date of the death of the policy holder; whichever is higher.

Accidental death and disability rider benefit

With the accidental death and disability rider benefit, in case of accidental demise of the insured person, an accidental rider benefit sum assured is payable as a lump-sum amount to the beneficiary of the policy along with the death benefit under the base plan.

i. Simple Reversionary Bonus: An amount per thousand Sum Assured is declared by LIC at the end of each year and this forms part of the guaranteed benefits. This is provided as a Simple Reversionary Bonus that accrues during the premium paying term and is paid to the policyholder or nominee at the end of the term or death in addition to the final additional bonus.

ii. Final Addition Bonus: Paid if the policy has run for a minimum period. Final Additional Bonus may be declared when a claim is made either as a result of death or maturity, provided the policy has been in effect for a minimum term.

| Buying LIC Policy Online with LICNewPolicyOnline.com | Buying A Policy Offline visiting LIC branch or through an agent | ||

|---|---|---|---|

| Address Proof | Aadhar Zip File | Address Proof | Aadhar |

| ID Proof | ID Proof | Pan Card or Aadhar | |

| Age Proof | Age Proof | Aadhar / Driving License | |

| Income Proof | IT Returns of last 2 years | ||

| Photo | Passport Photo | ||

| Buying Online Policy with LICNewPolicyOnline.com | |

|---|---|

| Address Proof | Aadhar |

| ID Proof | |

| Age Proof | |

| Buying A Policy Offline visiting LIC branch or through an agent | |

|---|---|

| Address Proof | Aadhar |

| ID Proof | Pan Card or Aadhar |

| Age Proof | Aadhar / Driving License |

| Income Proof | IT Returns of last 2 years |

| Photo | Passport Photo |

1. What is LIC the money back policy 20 years plan 75?

Its discontinued plan

2. What is the maturity amount of LIC money back policy plan 75?

Balance Sum assured along with vested bonus and final additional bonus is paid on maturity

3. What is new money-back plan 820?

In New Money Back plan, Policy term is 20 years, Premium paying term is 15 years, money back is paid every 5th year @ 20% of Sum Assured

4. Can I get loan on LIC money back policy?

Yes, you can avail loan Loan Eligibility after 2 years from date of commencement of the policy

5. What are the Conditions for Eligibility in this Plan?

Minimum age Eligibilty conditions of LIC Money Back Plan 20 Years 13 years and maximum age 50 years

LIC policyholders enjoy a sovereign guarantee on the sum assured and the bonus declared as per section 37 of LIC Act, 1956 which clearly states that "Policies to be guaranteed by Central Government - The sum assured by all policies issued by the corporation including any bonuses declared in respect thereof and, subject to the provisions contained in section 14 the amounts assured by all policies issued by any insurer the liabilities under which have vested in the corporation under this act, and all bonuses declared in respect thereof, whether before or after the appointed day, shall be guaranteed as to payment in cash by the Central Government."