The LIC Endowment Plan offers a convenient solution for individuals to save money while obtaining comprehensive protection. To keep things simple the LIC endowment plan comes with both death and maturity benefit. LIC New Endowment Plan Benefits You can buy the LIC Endowment Plan online and enjoy double tax benefits on both the premiums you pay and the returns you get.

Life becomes more meaningful with the achievement of personal milestones which you have planned for. But these milestones are often accompanied by added responsibilities, expenses and the burden of any uncertainty happening. We do our best to ensure that financial security is achieved through meticulous planning for key life stages such as marriage, parenthood, retirement, etc. Purchasing LIC Policy Online Buy LIC Policy Online without Agent it helps you achieve such goals whilst safeguarding the family’s future against unforeseen events. While there are many opportunities that come with respective benefits, the assurance and convenience that a life insurance plan with guaranteed benefits is irreplaceable.

Our success in life are not only measured by what we have accomplaished but also in overcoming the unforeseen hurdles occurring in our life at various stages. Uncertainity being a major hurdle in one’s life, it can only be best handled by being prepared for it. Life Insurance is a powerful tool which helps us to face the lifes uncertainity – your absence.

“because whatever excuses you have had for not taking a insurance, will only sound ridiculous for your loved ones in your absence”

Life demands certain financial needs for achieving short and long term goals such as Higher Education, Marriage, Parenthood, Dream House, Old Age Provision, Medical Expenses, Pension Protection, Creating wealth etc. which are fulfilled by your continuous and timely commitment.

The calamity of life would create a void in your loved ones life depriving them the essence of a beautiful life. The impact of the disaster can be reduced to an major extent by being Insured.

| Minimum age | 8 years (Completed) |

| Maximum age | 55 years |

| Maximum maturity age | 75 years |

| Policy Term | 12 years to 35 years |

| Minimum Sum Assured | Rs.1,00,000 |

| Maximum Sum Assured | No limit |

| Premium payment | Yearly / Half yearly / Quarterly / Monthly (ECS) |

| Loan | Eligible after 2 years |

| Surrender | Eligible after 2 years |

| On Death | Sum Assured + Accident risk cover + Bonus is payable |

| On Maturity | Sum Assured + Bonus is payable |

| Income Tax Benefits | (i) Premiums paid are eligible for Tax rebate u/s 80c (ii) Maturity amount / Death claim is Non-taxable u/s 10(10d) |

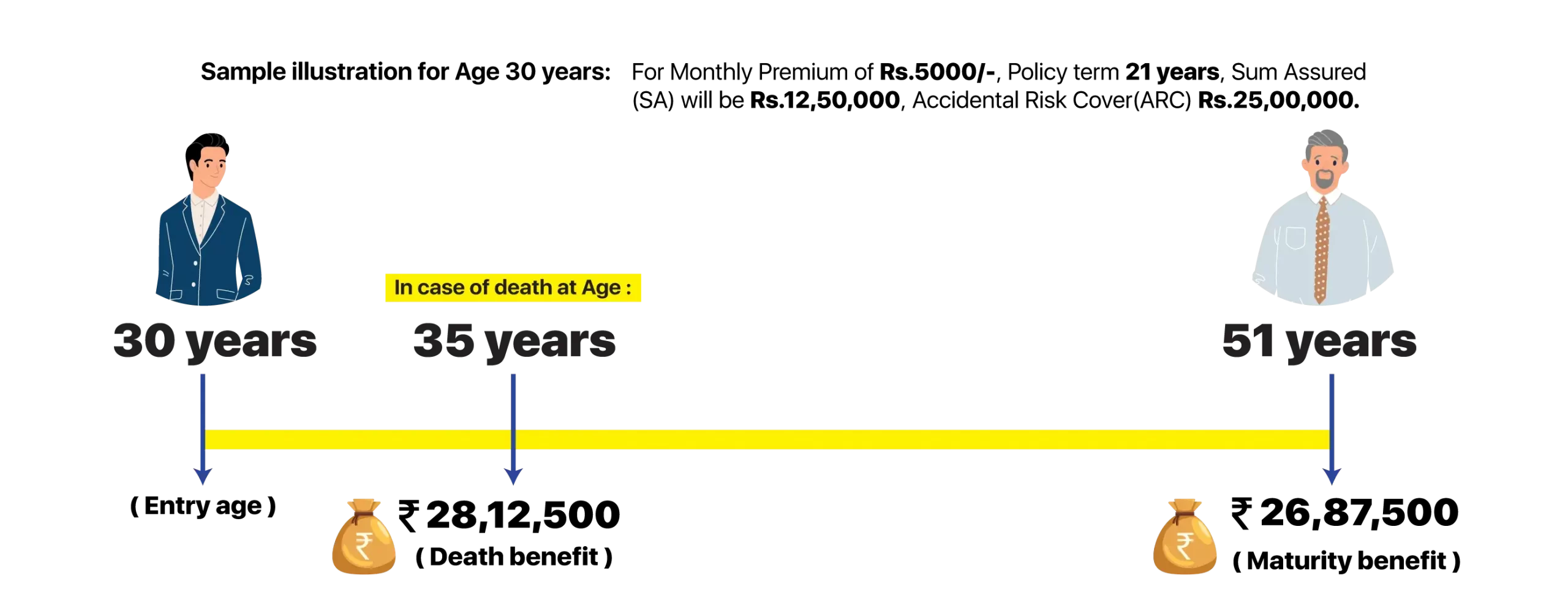

i. In case of the death of Life Insured, “Sum Assured on Death” shall be paid to the Nominee along with vested Simple Reversionary Bonus as Death Benefit and the policy would be terminated. The “Sum Assured on Death” will be equal to Basic Sum Assured or 10 times the Annualized Premium subject to a minimum of 105% of all Premiums paid, whichever is higher.

ii. By choosing to pay an extra premium, policyholders have the option to include the Accidental Death and Disability Benefit Rider. In the unfortunate event of the policyholder’s accidental demise, the beneficiary will receive a lump-sum amount equivalent to the accidental rider benefit sum assured, in addition to the death benefit provided by the base plan.

Policyholder can avail of discount on premium payment based on fulfilling the following criteria

i. Frequency of Payment: By paying annual premiums, a discount of 2% on the premium can be expected

ii. High Sum assured : If the policy holder opts for a higher value of sum assured starting from 2Lakhs till 4.95Lakhs, a discount of 2% on premium is available and 3% if sum assured is 5Lakhs and above.

Upon reaching the end of the policy term, if the policyholder survives, they will receive the sum assured, along with the accrued bonus including Simple Reversionary Bonus as maturity benefit and the policy tenure will proceed to lapse.

The New Endowment Plan offered by LIC includes a Surrender Value feature, whereby the insured is eligible to receive a certain percentage of the Premium Amount if they choose to surrender the policy after completing a minimum of two policy years.

Once the policyholder has paid the full premium amount for a minimum of two years and the policy has acquired a surrender value, they become eligible to avail a loan.

The LIC Endowment Plan allows policyholders to participate in the profits of LIC, with the policy accumulating Simple Reversionary Bonuses and Final Additional Bonus. These bonuses are determined based on the company’s experience. In the event of a Death Benefit or Maturity benefit, the insured is entitled to receive the Simple Reversionary Bonus.

Under section 80C, life insurance premiums up to Rs. 1,50,000 can be deducted from your taxable income. Furthermore, the maturity benefit received is tax-free under section 10(10D).

i. Sum Assured: A “Sum Assured on Death” defined as the amount that will be equal to Basic Sum Assured or 10 times the Annualized Premium subject to a minimum of 105% of all Premiums paid, whichever is higher – shall be paid on death of the policy holder

ii. Accidental death & disability rider: If the insured person suffers an accidental demise, the beneficiary of the policy will receive a lump-sum amount equivalent to the accidental rider benefit sum assured.

i. Accidental death and disability rider benefit

Under the plan, LIC’s Accidental Death and Disability Benefit Rider is offered as an optional cover. This cover will pay an additional sum to the insured in case of either accidental death or permanent disability caused due to an accident. In case of death due to accident, the beneficiary will receive an additional benefit in addition to sum assured offered in the base plan and the plan will terminate. In the event of permanent disablement, monthly instalments are paid during a span of 10 years and premiums are also waived off but policy will be still in force.

i. Final Addition Bonus

The final addition bonus is disbursed upon the policy’s maturity or in the event of the policyholder’s demise.

ii. Simple Reversionary Bonus

If the policyholder decides to surrender the policy prior to its completion, they will receive a portion of the accumulated bonus as per the surrender terms.

| Buying LIC Policy Online with LICNewPolicyOnline.com | Buying A Policy Offline visiting LIC branch or through an agent | ||

|---|---|---|---|

| Address Proof | Aadhar Zip File | Address Proof | Aadhar |

| ID Proof | ID Proof | Pan Card or Aadhar | |

| Age Proof | Age Proof | Aadhar / Driving License | |

| Income Proof | IT Returns of last 2 years | ||

| Photo | Passport Photo | ||

| Buying Online Policy with LICNewPolicyOnline.com | |

|---|---|

| Address Proof | Aadhar |

| ID Proof | |

| Age Proof | |

| Buying A Policy Offline visiting LIC branch or through an agent | |

|---|---|

| Address Proof | Aadhar |

| ID Proof | Pan Card or Aadhar |

| Age Proof | Aadhar / Driving License |

| Income Proof | IT Returns of last 2 years |

| Photo | Passport Photo |

1. What is the maturity benefit in endowment plan?

The maturity amount comprises of the sum assured, along with the vested bonus and the final additional bonus.

2. How can I claim LIC endowment maturity amount?

Original policy bond along with Pan copy, Aadhar copy & Bank details to be provided

3. What are the three types of endowments?

New Endowment plan, Jeevan Anand plan Best Endowment Policy of LIC & Jeevan Labh plan

4. How can I know my LIC endowment policy status?

You can check the status of your policy at the registered customer portal LIC Policy Status

5. Which is the best LIC endowment plan?

Jeevan Anand & Jeevan Labh Best Endowment Plan LIC are the best endowment plan

6. How can I pay my LIC Endowment policy premium online?

To pay LIC Endowment policy premium online, you have following options:

7. Which is better: LIC Term plan or LIC Endowment plan?

It depends on the Insurance coverage, financial goals and needs of the individual. Both the LIC Term Plan and the LIC Endowment Plan are good options. The LIC Term Plan offers a higher death benefit with a low premium and no maturity returns, while the LIC Endowment plan Best endowment plan of LIC is a combination of risk cover with higher returns. Ultimately the best choice for you is the one that best meets your goals.

In the end, you should look at the coverage required along with your financial goals and needs and talk to a financial advisor about which type of plan would be best for you.

8. Is LIC Endowment policy tax free?

Yes, LIC Endowment policies offer dual tax benefits. Firstly, the premiums paid towards the policy are eligible for tax exemption under Section 80C of the Income Tax Act. Secondly, the maturity proceeds received from the policy are tax-free under Section 10(10D) of the Income Tax Act.

9. What happens when your Endowment policy matures?

When an Endowment policy LIC Endowment Policy reaches its maturity date, the policyholder will receive a tax-free maturity benefit. This benefit includes the sum assured, any applicable bonuses, and the final additional bonus. The policyholder can choose to receive the maturity benefit either as a lump sum payment or in installment payments.

LIC policyholders enjoy a sovereign guarantee on the sum assured and the bonus declared as per section 37 of LIC Act, 1956 which clearly states that "Policies to be guaranteed by Central Government - The sum assured by all policies issued by the corporation including any bonuses declared in respect thereof and, subject to the provisions contained in section 14 the amounts assured by all policies issued by any insurer the liabilities under which have vested in the corporation under this act, and all bonuses declared in respect thereof, whether before or after the appointed day, shall be guaranteed as to payment in cash by the Central Government."