Not all insurance plans are created equally, and this is especially true in case of High Net Worth individuals. We at LIC understand this better and are always innovating to cater to the unique circumstances and personal passions of highly discerning clients. As an individual’s wealth profile changes, so do their insurance coverage requirements. LIC Jeevan Shiromani Plan LIC Jeevan Shiromani Money Back plan provides an excellent means of ensuring financial security for your family in the event of an unfortunate incident occurring throughout the duration of the policy. The plan starts with a minimum sum assured of Rs.1 Crore, making it a great option for those looking for peace of mind.

LIC introduces a Premium plan for Premium clients Jeevan shiromani for High Net worth individuals. This is a traditional, conventional with profit plan, which is not linked to any share market. Periodic money back payments shall also be paid to policyholders at specified durations during the policy term and a lump sum tax free amount is paid at the end of policy term. This LIC Jeevan Shiromani Policy Buy LIC Jeevan Shiromani Policy Online has a unique combination of Protection, Savings, Free medical cover against 15 major diseases, limited premium payment with attractive guaranteed returns plan with Tax benefits and loan facility.

The list of 15 Inbuilt Critical Illness covered under this policy:

| Minimum Entry age | 18 years |

| Maximum Entry age | 55 years for Policy term 14 years 51 years for Policy term 16 years 48 years for Policy term 18 years 45 years for Policy term 20 years |

| Policy term | 14, 16, 18 & 20 years |

| Premium paying term | Policy term minus 4 years |

| Minimum Sum Assured | Rs. 1 Crore |

| Maximum Sum Assured | No limit |

| Premium payment | Yearly / Half yearly / Quarterly / Monthly (ECS) |

| Loan | Eligible after 1st year |

| Surrender | Eligible after 2nd year |

| Critical Illness (In built) | 15 Major diseases are covered |

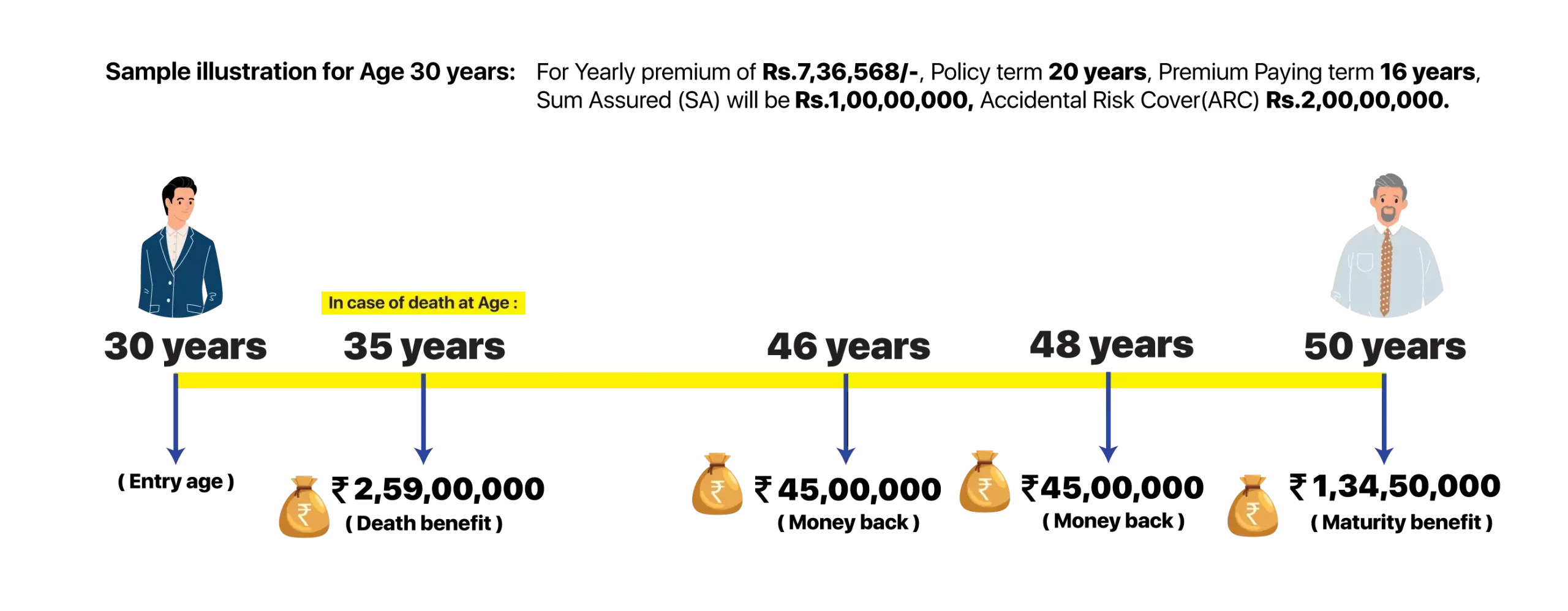

| Money Back at | For Policy term 14 years, 30% of SA in 10th & 12th year For Policy term 16 years, 35% of SA in 12th & 14th year For Policy term 18 years, 40% of SA in 14th & 16th year For Policy term 20 years, 45% of SA in 16th & 18th year |

| On Maturity | Balance Sum Assured + Guaranteed Additions + Loyalty Addition |

| Income Tax Benefits | (i) Premiums paid are eligible for Tax rebate u/s 80c (ii) Money Back amount/ Maturity amount / Death claim is Non-taxable u/s 10(10d) |

LIC Jeevan Shiromani Plan Benefits

LIC Jeevan Shiromani Plan Benefits i. If the policy holder dies during the first five years of the policy, then they will get the sum assured plus accrued guaranteed additions paid out.

ii. If the policy holder dies after completion of five years, but before their policy has matured in full, the sum assured plus accrued guaranteed additions and loyalty additions will also be paid out.

Sum Assured on death (amount payable is higher of)

LIC’s Jeevan Shiromani survival benefit is paid to the life assured at every stage of survival during the tenure of the policy. Provided that the policyholder survives the policy term and has made all premium payments as required, the beneficiaries will receive a predetermined percentage of the total sum assured amount. beneficiaries as follows:

i. For a policy term of 14 years, 30% of the basic sum assured on the 10th and 12th policy anniversary.

ii. For a policy term of 16 years, 35% of the basic sum assured on the 12th and 14th policy anniversary.

iii. For a policy term of 18 years, 40% of the basic sum assured on the 14th and the 16th policy anniversary.

iv. For a policy term of 20 years, 45% of the basic sum assured on the 16th and the 18th policy anniversary.

The maturity benefit is paid when the life assured survives the entire duration of the policy term. If policyholder survives the policy term and all the premiums are paid, a fixed percentage of the basic sum assured will be paid as follows:

i. 14 years policy term: 40% of the basic sum assured

ii. 16 years policy term: 30% of the basic sum assured

iii. 18 years policy term: 20% of the basic sum assured

iv. 20 years policy term: 10% of the basic sum assured

Upon surrendering the policy after the complete payment of all premiums for the first year, the policyholder becomes eligible to receive the guaranteed surrender value. The guaranteed surrender value is determined by calculating the sum of all premiums paid up to that specific date.

In order to obtain a Jeevan Shiromani loan through your policy, you will have to have paid all the premiums for one year. The maximum loan amount you can obtain is 90% of the surrender value in the case of in-force policies and 80% if the policy is paid up.

LIC Jeevan Shiromani policy participates in the profits of LIC, and this participation is reflected in the form of Guaranteed Additions and Loyalty Additions. These additions enhance the policy benefits and are declared based on the company’s experience. The insured can receive these additions either as part of the Death Benefit or as a component of the Maturity benefit.

The premiums paid for purchasing LIC Jeevan Shiromani policy qualify as a tax-free deduction under Section 80C of the Income Tax Act. Individuals can claim a maximum deduction of INR 1.5 lakhs on this premium amount. Additionally, as per Section 10(10D) of the Income Tax Act, all benefits received, including death and maturity benefits, are exempt from tax.

i. Accidental death and disability rider benefit

By opting for the accidental death and disability rider benefit, the beneficiary of the policy receives a lump-sum amount equal to the accidental rider benefit sum assured in the event of the insured person’s accidental demise. This amount is provided in addition to the death benefit under the base plan.

ii. Accidental Benefit Rider

The accidental benefit rider allows the policyholder to receive a lump-sum payout in case of accidental death within 180 days from the date of the accident. To avail this rider, an additional premium must be paid along with the life insurance policy.

iii. New Term Assurance Rider

At the beginning of the policy, the LIC New Term Assurance Rider can be obtained. Under this rider option, the policyholder’s beneficiary will be eligible for an additional sum assured amount for term assurance if the policyholder passes away during the policy tenure.

iv. Critical Illness Rider

This rider can be availed at the inception of the policy and under this rider option, LIC will offer the beneficiary a lump-sum equivalent of 10% of the basic sum assured in case of the policy holder is diagnosed with any one of the 15 critical illnesses covered under this rider during the policy tenure. The critical illness rider can be obtained when initiating the policy, and it provides the beneficiary with a lump-sum amount equivalent to 10% of the basic sum assured if the policyholder is diagnosed with any of the 15 covered critical illnesses during the policy tenure.

Deferred Premium Payment: Allowed for two years from the illness acceptance date.

As a participating plan, policyholders of LIC Jeevan Shiromani will receive benefits in the form of loyalty additions after 5 years of premiums have been paid. The amount available to be received is determined by the company’s financial performance. For paid-up policies, loyalty additions are calculated on the number of years that premiums have been paid for. If the policy is surrendered, loyalty additions would be based on the number of years that the premium was paid.

| Buying LIC Policy Online with LICNewPolicyOnline.com | Buying A Policy Offline visiting LIC branch or through an agent | ||

|---|---|---|---|

| Address Proof | Aadhar Zip File | Address Proof | Aadhar |

| ID Proof | ID Proof | Pan Card or Aadhar | |

| Age Proof | Age Proof | Aadhar / Driving License | |

| Income Proof | IT Returns of last 2 years | ||

| Photo | Passport Photo | ||

| Buying Online Policy with LICNewPolicyOnline.com | |

|---|---|

| Address Proof | Aadhar |

| ID Proof | |

| Age Proof | |

| Buying A Policy Offline visiting LIC branch or through an agent | |

|---|---|

| Address Proof | Aadhar |

| ID Proof | Pan Card or Aadhar |

| Age Proof | Aadhar / Driving License |

| Income Proof | IT Returns of last 2 years |

| Photo | Passport Photo |

1. What is the premium for Jeevan Shiromani?

The minimum Sum assured for Jeevan Shiromani plan is Rs.1 Crore and premium starts from Rs.7,25,000 per annum

2. What is the minimum SA under Jeevan Shiromani plan?

Minimum Sum assured under Jeevan Shiromani is Rs. 1 crore

3. What is minimum sum assured for Jeevan Shiromani?

Minimum Sum assured in Jeevan Shiromani is Rs.1 Crore.

4. Can I avail Loan on my Jeevan Shiromani Policy?

Yes, After one year from the policy commencement date, individuals have the option to avail a loan.

5. Does the LIC Jeevan Shiromani Policy provide for deferred survival and maturity benefits?

Yes, Jeevan Shiromani plan provides Survival benefit Survival Benefit of LIC Jeevan Shiromani at the fixed intervals and also Maturity benefit at the end of the policy term

6. What is the Guaranteed Addition accrual rate under the LIC Jeevan Shiromani Plan?

The Guaranteed addition for 1st 5 years is Rs.50 per 1000 Sum assured and from 6th year onwards Rs.55 per 1000 Sum assured

LIC policyholders enjoy a sovereign guarantee on the sum assured and the bonus declared as per section 37 of LIC Act, 1956 which clearly states that "Policies to be guaranteed by Central Government - The sum assured by all policies issued by the corporation including any bonuses declared in respect thereof and, subject to the provisions contained in section 14 the amounts assured by all policies issued by any insurer the liabilities under which have vested in the corporation under this act, and all bonuses declared in respect thereof, whether before or after the appointed day, shall be guaranteed as to payment in cash by the Central Government."