LIC Jeevan Labh is a popular life insurance policy offered by the Life Insurance Corporation of India (LIC). It is a non-linked, with-profits endowment plan that provides financial security to policyholders and their families. With attractive features and a high bonus rate, this policy has gained immense popularity among individuals seeking long-term investment and insurance coverage.

Now, buying the LIC Jeevan Labh policy Buy LIC Jeeva Labh Policy is easier than ever before. LIC has introduced the option to purchase this policy online, making the buying process hassle-free and convenient. By opting to buy LIC Jeevan Labh online, policyholders can avail themselves of the benefits of this policy from the comfort of their homes.

“It’s not about your needs, it’s about what your family needs when you’re NOT around.”

We always question yourself as to “ why should I take insurance”, as I am healthy. But the life’s truth is that diseases, old age, and death touch all families. When such calamity strikes, how well we handle it solely depends on how we have planned and secured the timely financial security of our loved ones.

Purchasing LIC Jeevan Labh online provides several advantages. It saves time and effort as policyholders can complete the buying process within minutes, eliminating the need for physical visits to LIC branches. In addition, online purchase offers greater transparency and access to information, allowing individuals to read through policy details, features, and payment options at their convenience.

To enjoy the benefits of LIC Jeevan Labh policy Benefits LIC Jeevan Labh Plan , individuals can now purchase it online, ensuring a smooth and hassle-free experience.

| Minimum Age | 8 years(Completed) |

| Maximum Age | 59 years for 16 years policy term 54 years for 21 years policy term 50 years for 25 years policy term |

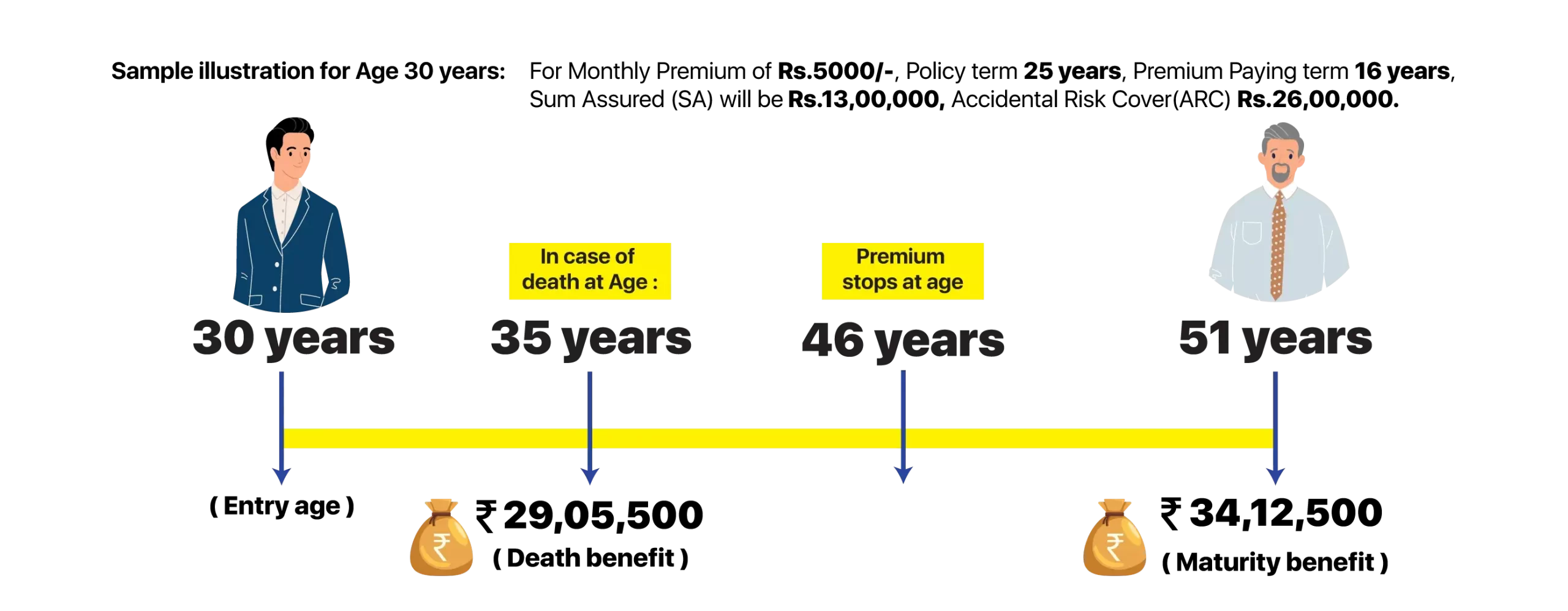

| Policy Term | 16 years / 21 years / 25 years |

| Premium paying term | 10 years (for 16 years policy term) 15 years (for 21 years policy term) 16 years (for 25 years policy term) |

| Minimum Sum Assured | Rs.2,00,000 |

| Maximum Sum Assured | No limit |

| Premium payment mode | Yearly / Half yearly / Quarterly / Monthly (ECS) |

| Loan | Eligible after 2 years |

| Surrender | Eligible after 2 years |

| On Death | Sum Assured + Bonus |

| On Maturity | Sum Assured + Bonus + Final bonus |

| Income Tax Benefits | (i) Premiums paid are eligible for Tax rebate u/s 80c (ii) Maturity amount / Death claim is Non taxable u/s 10(10d) |

LIC Jeevan Labh Benefits

LIC Jeevan Labh Benefits In the unfortunate event of the policy holder’s demise during the policy term, the death benefits will include the Sum Assured on death, vested bonuses, and the Final Bonus declared by LIC. The Sum Assured on Death will be the higher value of either 125% of the Basic Sum Assured or 10 times the annual premium.

In Jeevan Labh, a policyholder needs to pay premium during Premium Paying Term (PPT) and then the policyholder has to wait for completion of Policy Term before receiving maturity amount which is equal to Basic Sum Assured + Simple Reversionary Bonus + Final Addition Bonus (FAB), if any.

The LIC Jeevan Labh Plan includes a Surrender Value provision, which allows the insured to receive a percentage of the Premium Amount if they choose to surrender the policy after completing three years of coverage.

A policyholder becomes eligible for a loan once they have paid the full premium amount for two years and the policy has acquired a surrender value.

The policy offers a tax benefit wherein the premium deposited, up to Rs 1.5 lakh per financial year, qualifies for exemption under section 80C of the Income Tax Act. Additionally, the maturity amount, which is ten times the annual premium, is also exempt from taxes under section 10(10D).

LIC Jeevan Labh LIC Jeevan Labh Online Purchase entitles policyholders to share in the profits of LIC, and the policy accrues Simple Reversionary Bonuses and Final Additional Bonus, which increase the benefits and are declared based on the company’s experience. Simple Reversionary Bonus is provided to the insured either as part of the Death Benefit or the Maturity benefit.

Upon the demise of the policyholder, the nominee shall be entitled to receive the Sum Assured on death along with any accrued bonuses and final bonus as declared by LIC. By opting for additional premium and opting for riders, the policy holder can also be covered against Accidental Death & Disability and can avail of Term Assurance benefit LIC’s Term Assurance Rider on his life.

i. Accidental death and disability rider benefit

In the Jeevan Labh Plan by LIC, the accidental death and disability rider provides a lump-sum accidental rider benefit sum assured to the beneficiary upon accidental demise of the insured, alongside the base plan’s death benefit. Likewise, accidental disability entitles the insured to receive the accidental rider benefit sum assured in equal monthly instalments for 10 years, while waiving all current and future premiums.

ii. New Term Assurance Rider

The LIC New Term Assurance Rider can be added to the policy at the start. With this rider, the beneficiary will receive an extra sum assured amount if the policyholder passes away during the policy term. This rider is valid for 35 years or until the policyholder reaches 75 years of age, whichever occurs first.

i. Maturity or Death Bonus

The Final Addition Bonus is a bonus amount paid upon the policy’s maturity or in the event of death.

ii. Surrender Bonus

If you choose to surrender the policy before its completion, a portion of the accumulated bonus will be paid to you.

| Buying LIC Policy Online with LICNewPolicyOnline.com | Buying A Policy Offline visiting LIC branch or through an agent | ||

|---|---|---|---|

| Address Proof | Aadhar Zip File | Address Proof | Aadhar |

| ID Proof | ID Proof | Pan Card or Aadhar | |

| Age Proof | Age Proof | Aadhar / Driving License | |

| Income Proof | IT Returns of last 2 years | ||

| Photo | Passport Photo | ||

| Buying Online Policy with LICNewPolicyOnline.com | |

|---|---|

| Address Proof | Aadhar |

| ID Proof | |

| Age Proof | |

| Buying A Policy Offline visiting LIC branch or through an agent | |

|---|---|

| Address Proof | Aadhar |

| ID Proof | Pan Card or Aadhar |

| Age Proof | Aadhar / Driving License |

| Income Proof | IT Returns of last 2 years |

| Photo | Passport Photo |

1. What happens if premiums are not paid within the grace period?

Policy will lapse and Insurance coverage will stop.

2. How is LIC Jeevan Labh policy profitable from an investment point of view?

It's a high returns plan. For policy term 25 years, your returns will be 3.5 times of the premiums paid.

3. Which LIC Scheme should I apply for with a premium not exceeding 3,000/month, if I am a government employee?

Jeevan Anand & Jeevan Labh

LIC policyholders enjoy a sovereign guarantee on the sum assured and the bonus declared as per section 37 of LIC Act, 1956 which clearly states that "Policies to be guaranteed by Central Government - The sum assured by all policies issued by the corporation including any bonuses declared in respect thereof and, subject to the provisions contained in section 14 the amounts assured by all policies issued by any insurer the liabilities under which have vested in the corporation under this act, and all bonuses declared in respect thereof, whether before or after the appointed day, shall be guaranteed as to payment in cash by the Central Government."