The best way to safeguard yourself and your loved ones from any unforeseen difficulties is to buy LIC Jeevan Anand Policy Online How to buy LIC Jeevan Anand Policy Online. No one knows what the future holds, but we can all agree that life comes with a lot of financial challenges and commitments that we have to be prepared for. “LIC Jeevan Anand” is a comprehensive solution plan that offers dual benefits, providing an all-in-one solution. —“LIC Jeevan Anand”.

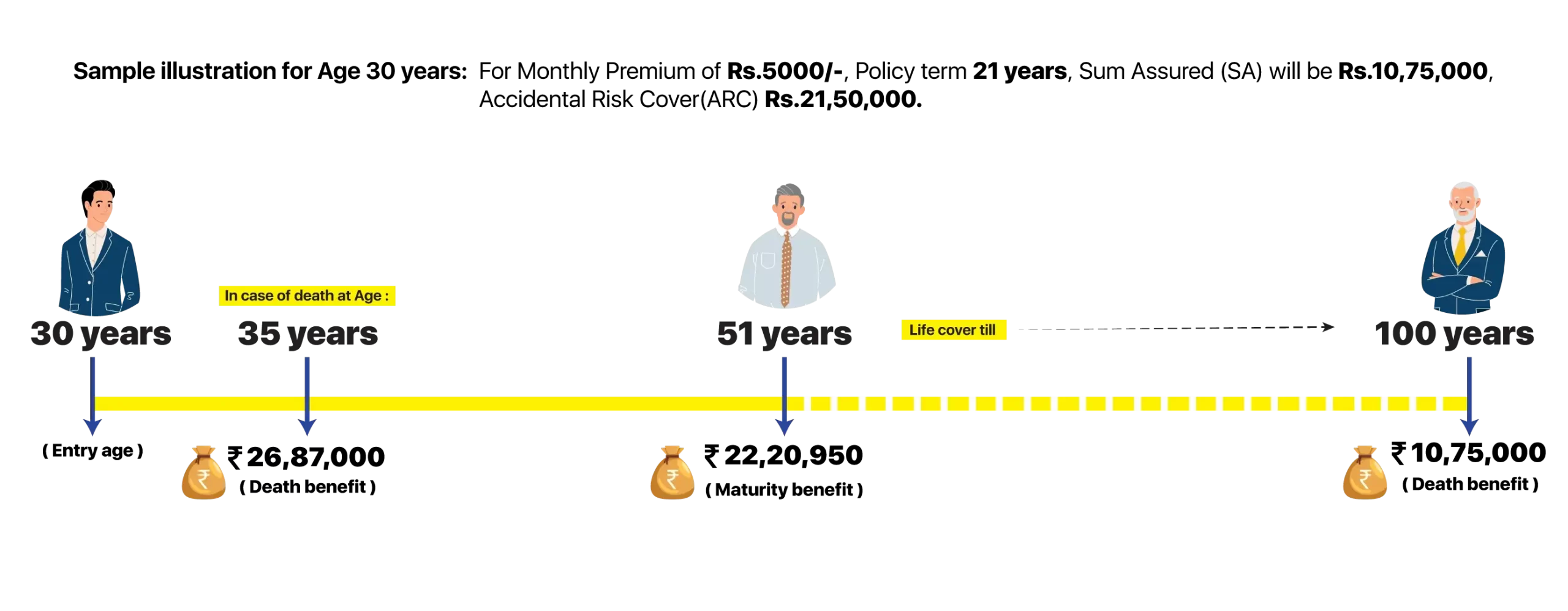

In this policy, a lump sum amount is paid twice to the policyholder during his/her lifetime under a single policy. First lumpsum amount is paid at the end of the selected policy term and the Second lumpsum amount is paid on the death of the policy holder. This policy ensures that the policyholder is insured right from the time he/she takes the policy till his/her death.

LIC JEEVAN ANAND PLAN is a regular premium paying plan, which is not related to any share market, it is a traditional conventional profit plan with all the benefits like Insurance cover, Accidental & Permanent disability rider, Savings, Tax-benefits under section 80C, Tax free Maturity and Death claim amount, Loan, Surrender option etc…

“A man who dies without adequate life Insurance should have to come back and see the mess he has created”

| Minimum Age | 18 Years Completed |

| Maximum Age | 50years |

| Maximum Maturity Age | 75 years |

| Policy Term | 15 years to 35years |

| Minimum Sum Assured | Rs,1,00,000 |

| Maximum Sum Assured | No limit |

| Premium Payment | Yearly / Half yearly / Quarterly / Monthly (ECS) |

| Loan | Eligible after 2 years |

| Surrender | Eligible After 2 Years |

| On Maturity | Sum Assured + Bonus + Final Bonus is payable |

| On Death before Maturity | 125% of Sum Assured + Bonus is payable |

| On Death after Maturity | Sum Assured is payable |

LIC Jeevan Anand Policy Benefits

LIC Jeevan Anand Policy Benefits i. In the event of the demise of the policyholder during the tenure of the LIC ‘New Jeevan Anand’ plan, the death benefits will comprise:

ii. If the policy holder expires after the plan duration, then a Basic Sum Assured is paid to the beneficiary in addition to the maturity benefit that has already been paid.

The Sum Assured on Death is the greater of :

Considering all the premiums have been paid in full the Maturity benefit will include the Sum assured along with reversionary bonus and final additional bonus will be disbursed upon the completion of the policy term.

If the policy is surrendered after at least three years and all the premiums are paid promptly, guaranteed surrender value can be availed. Guaranteed surrender value is calculated through the total of all the premiums paid till that date.

A policyholder becomes eligible for a loan after two years of complete premium payments, once the policy has acquired a surrender value.

LIC New Jeevan Anand policy shares in the profits of LIC and accrues Simple Reversionary Bonuses and Final Additional Bonus, which enhance the policy’s benefits and are determined based on the company’s experience. The insured receives Simple Reversionary Bonus as a component of the Death Benefit or as part of the Maturity benefit.

The premiums paid for purchasing LIC New Jeevan Anand policy Key features of LIC Jeevan Anand Policy are eligible for tax-free deduction under Section 80C of the Income Tax Act. An individual can claim a maximum deduction of INR 1.5 lakhs on these premiums. Furthermore, as per Section 10 (10D) of the Income Tax Act, all benefits received, including death and maturity benefits, are also exempt from tax.

i. Life cover during the policy term: In the event of the policyholder’s death during the policy term, the nominee will receive the Sum Assured on Death along with any vested bonuses and final bonuses that have been declared.

ii. Life cover after the policy term: If the policyholder passes away after the policy term has ended, the nominee will receive the Basic Sum Assured.

i. Accidental death and disability rider benefit

In the event of an accidental death or disability, the accidental death and disability rider benefit provides additional protection. In addition to the death benefit provided by the base plan, the beneficiary of the policy will receive a lump sum amount equal to the sum assured of the accidental rider benefit in the event that the insured person dies in an accident. Similarly, the accidental rider benefit sum assured will be distributed monthly for ten years to the insured person in the event that the insured person becomes disabled as a result of an accident. In addition, any and all premiums that have already been paid or will soon be due will be waived.

i. Final Addition Bonus

This is a bonus which is paid at the time of maturity or death.

ii. Simple Reversionary Bonus

If you decide to exit from the policy during the policy period by surrendering it, then a certain portion of such accrued bonus will be payable to you

| Buying LIC Policy Online with LICNewPolicyOnline.com | Buying A Policy Offline visiting LIC branch or through an agent | ||

|---|---|---|---|

| Address Proof | Aadhar Zip File | Address Proof | Aadhar |

| ID Proof | ID Proof | Pan Card or Aadhar | |

| Age Proof | Age Proof | Aadhar / Driving License | |

| Income Proof | IT Returns of last 2 years | ||

| Photo | Passport Photo | ||

| Buying Online Policy with LICNewPolicyOnline.com | |

|---|---|

| Address Proof | Aadhar |

| ID Proof | |

| Age Proof | |

| Buying A Policy Offline visiting LIC branch or through an agent | |

|---|---|

| Address Proof | Aadhar |

| ID Proof | Pan Card or Aadhar |

| Age Proof | Aadhar / Driving License |

| Income Proof | IT Returns of last 2 years |

| Photo | Passport Photo |

1. What happens when we stop paying the LIC Jeevan Anand Premiums?

Policy lapses, Insurance Risk cover stops, Can Surrender the policy after 2 years from date of commencement

2. Can I take loan in against my Jeevan Anand Policy?

Yes, after 2 full years Premium paid

3. Which one is better LIC Jeevan Anand Policy or PPF?

LIC Jeevan Anand Buy LIC Jeevan Anand Online, as it has Insurance cover, fixed premium, loan and Surrender option available.

4. I have LIC Jeevan Anand Policy and Paid premium of 8 years, If I stop further premiums what would happen to paid premiums?

You can claim Surrender value LIC Jeevan Anand surrender value calculator and take back your amount

5. Should I purchase LIC Jeevan Anand Cum Whole Life Policy?

LIC Jeevan Anand plan is inclusive of Whole life cover

6. What is the best plan to avail in the short term, which not only covers accidental and death event but also handsome benefits.

Jeevan Labh plan LIC Jeevan Labh Policy, Minimum premium paying term is 10 years

7. Which policy is best: LIC’s Jeevan Lakshya or LIC’s Jeevan Anand?

When it comes to choosing between the LIC Jeevan Lakshya plan and the LIC Jeevan Anand policy, it ultimately comes down to your personal needs and preferences.

LIC’s Jeevan Lakshay plan is a policy typically taken by the parents for the benefit of their children. This plan offers an annual payout of 10% of the Sum assured to the family in the event of the policy holder's death at any point during the policy term. If the policy holder survives until the end of the policy term, a lump sum payment is then made - regardless of whether or not the policy holder survives.

Jeevan Anand is a double benefit plan that provides Savings and Protection for whole life. This plan gives the benefit of full payout At the conclusion of the policy term, Jeevan Anand, a double benefit plan, provides a maturity amount, serving as a full payout. Additionally, lifelong coverage for risks is provided once again. term as maturity amount, and again free risk is covered for lifetime.

In conclusion, the choice between the two policies depends on your personal needs and preferences.You can choose to buy LIC Jeevan Anand policy online or LIC Jeevan Lakshya plan according to your need. If you are looking for a plan for the benefit of your child, Jeevan Lakshya will be a good option for you. However, if you are looking for whole life coverage, Jeevan Anand will be a better choice for you.

LIC policyholders enjoy a sovereign guarantee on the sum assured and the bonus declared as per section 37 of LIC Act, 1956 which clearly states that "Policies to be guaranteed by Central Government - The sum assured by all policies issued by the corporation including any bonuses declared in respect thereof and, subject to the provisions contained in section 14 the amounts assured by all policies issued by any insurer the liabilities under which have vested in the corporation under this act, and all bonuses declared in respect thereof, whether before or after the appointed day, shall be guaranteed as to payment in cash by the Central Government."