In the present era, children’s aspirations have expanded exponentially and become more targeted compared to previous generations. As forward-thinking parents of today, we actively inspire our young ones to set higher goals and leave no opportunity unexplored. We possess a clear vision and meticulously plan for their future, comprehending the utmost significance of realizing their dreams. Acknowledging this paradigm shift, LIC offers one of the best policies for children, known as the LIC New Jeevan Tarun Plan.

This extraordinary policy, tailored specifically to cater to children’s needs, has earned a distinguished reputation as an exemplary choice for securing your child’s future. Acting as a catalyst in their pursuit of goals, this plan showcases LIC’s commitment to empowering children and ensuring their well-being.

Turn your Champs dream into reality

Education provides the much-needed skills required to navigate the world. Have you started planning for your child’s higher education?

Children grow fast but their needs grow faster. How did you plan for their future? Since the birth of the child we, as parents, make sincere efforts to ensure that the child can dream big without having second thoughts and hence work towards accomplishing his/her dreams. Now you can buy LIC Jeevan Tarun Online LIC Jeevan Tarun Online Purchase and we are here to help you empower your child’s dreams and live the rest of your life as the proud parents you deserve to be.

A child education plan is a combination of investment and insurance. It will help them focus on their career without worrying about finances even in your absence. The returns would be sufficient to help your child meet his future needs even when you are not around.

When it comes to your child’s education, it is a must to start saving as early as possible; to be financially prepared to support your Child’s dream. You could save up little by little every month, build up a fund over the long term or you could start saving with a child insurance plan. You can choose to get returns at important stages of your Child’s life.

The future of your child is your prime responsibility and also a big reason for your worries. You want to provide the best education for your child. But given the steeply rising cost of education in the country, you will need a substantial amount of savings to cover your child’s higher education expenses. Hence, regular investments in the right plan can help you build a large sum over time. That said, LIC Jeevan Tarun online purchase Benefits of LIC Jeevan Tarun not only helps in creating a financial corpus for your child’s education, you also need to ensure they are financially secure in case of your absence.

With insurance plans tailored to provide specific benefits for your children, you get dual benefits. The LIC Jeevan Tarun scheme combines financial protection for the child along with savings/wealth building that allows you to build a significant sum for the future.

| Minimum age | 90 days completed |

| Maximum age | 12 years |

| Policy Term | 25 minus (-) Age at entry |

| Premium paying term | 20 minus (-) Age at entry |

| Minimum Sum Assured | Rs. 75,000 |

| Maximum Sum Assured | No limit |

| Premium payment | Yearly / Half yearly / Quarterly / Monthly (Through Bank) |

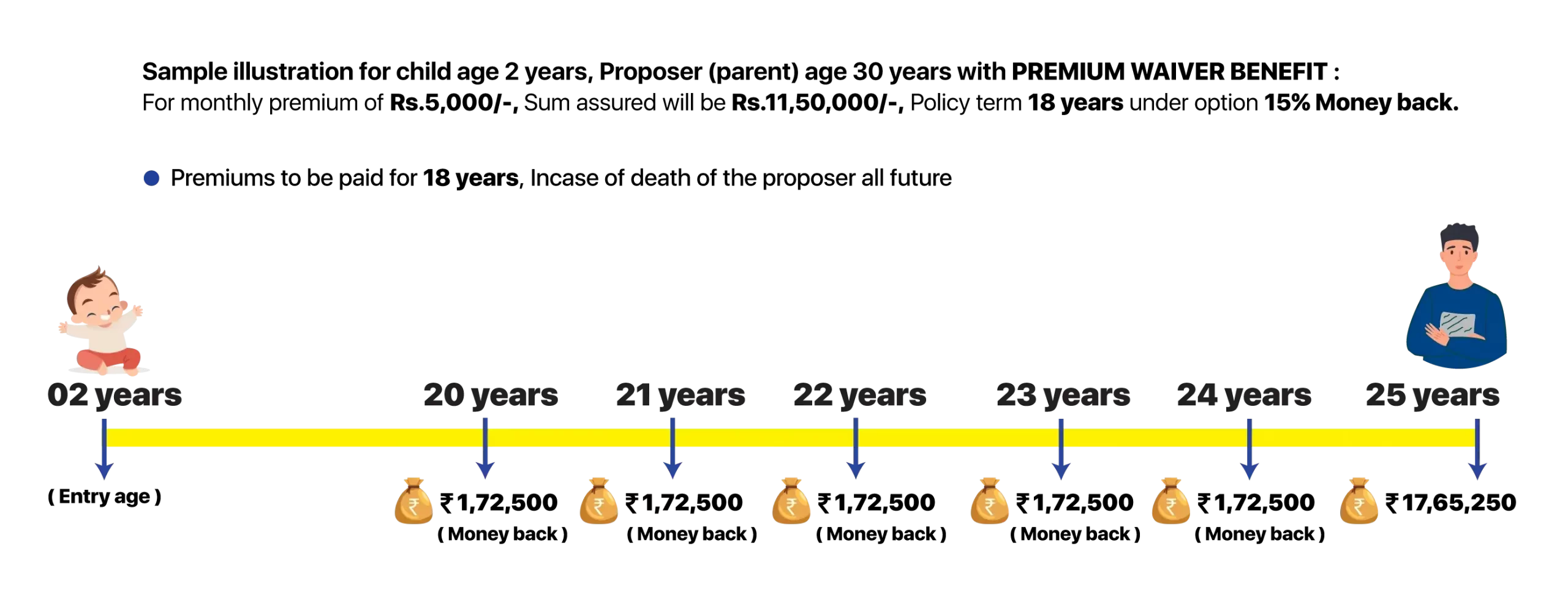

| Money back options | OPTION 1 - No money back is paid (100% of Sum assured + Bonus is paid at age 25 years) OPTION 2 - 5% of Sum assured is paid every year for 5 years from child age 20 to 24 years OPTION 3 - 10% of Sum assured is paid every year for 5 years from child age 20 to 24 years OPTION 4 - 15% of Sum assured is paid every year for 5 years from child age 20 to 24 years |

| Loan | Available after 3 years |

| Surrender | Available after 3 years |

| On Maturity | OPTION 1 - 100% of Sum assured + Bonus at child age 25 years OPTION 2 - 75% of Sum assured + Bonus at child age 25 years OPTION 3 - 50% of Sum assured + Bonus at child age 25 years OPTION 4 - 15% of Sum assured + Bonus at child age 25 years |

| Premium waiver benefit | Available from age 18 years to 55 years of proposer |

| Income Tax Benefits | (i) Premiums paid are eligible for Tax rebate u/s 80c (ii) Maturity amount / Death claim is non-taxable u/s 10(10d) |

This is linked to the date of commencement of risk.

i. In case of death of the child happens before commencement of risk (Risk cover would start from the second policy anniversary), all premiums paid will be returned to the nominee, excluding taxes and rider premiums

ii. In case the death of the child happens after commencement of risk the nominee will receive the Sum Assured on Death along with Simple Reversionary Bonus & any Final Addition Bonus declared throughout the policy term.

The Sum Assured on Death is higher of the following:

The survival benefits in this plan wherein if the policyholder survives the policy tenure and if all premiums have been accordingly paid, then a fixed percentage of the overall sum assured amount will be awarded to the policyholder as he turns 20 years and thereafter on each of next four policy anniversaries.

Options for choosing the survival benefits are as follows:

| Options | Survival Benefits |

|---|---|

| Option 1 | Nil |

| Option 2 | 5% of Sum Assured paid every year for the last 5 policy years |

| Option 3 | 10% of Sum Assured paid every year for the last 5 policy years |

| Option 4 | 15% of Sum Assured paid every year for the last 5 policy years |

Maturity benefit is payable on survival of the life assured through the entire Policy Term, then a fixed percentage of sum assured along with reversionary bonuses and final additional bonus will be paid as the maturity benefit. Policy holder can opt for maturity benefit pay-outs with the following options:

| Options | Maturity Benefits |

|---|---|

| Option 1 | 100% of Sum Assured + vested Bonuses |

| Option 2 | The remaining 75% of the Sum Assured is paid + vested Bonuses |

| Option 3 | The remaining 50% of the Sum Assured is paid + vested Bonuses |

| Option 4 | The remaining 25% of the Sum Assured is paid + vested Bonuses |

LIC’s New Jeevan Tarun also comes with a Surrender Value feature under which a particular percentage of the Premium Amount is given back to the insured in case the policy holder decides to surrender the policy after completion of 3 policy years.

A policyholder is eligible for a loan if 3 years the full premium amount is paid, followed by the policy acquiring a surrender value.

As a policyholder the participant, you are entitled to the profits of the insurance company by way of eligible for Simple Reversionary Bonus and Final Additional Bonus Final Additional Bonus LIC as declared by LIC and will be paid at the time of Maturity of the policy or as the death benefit.

The premiums paid towards buying LIC New Children’s Money Back Plan Best Childrens Plan is considered as a tax-free deduction under Section 80C of the Income Tax Act. One can claim a maximum deduction of INR 1.5 lakhs on this amount. The section 10 (10D) of the Income Tax Act allows us to put all the benefits received including death and maturity benefits

Life cover during the policy term: If the death of policyholder occurs during the policy term, the nominee will receive the Sum Assured on Death plus simple reversionary bonuses and final additional bonus declared

LIC’s Premium Waiver Benefit Rider

The LIC’s New Jeevan Tarun Plan comes with a very useful premium waiver rider which is available for the life of proposer aged between 18 to 55 years. The rider can be attached to the base plan for an additional premium. If the proposer dies within the active policy term, then the future premiums under the basic plan will be waived off.

i. Simple Reversionary Bonus: An amount per thousand Sum Assured is declared by LIC at the end of each year and this forms part of the guaranteed benefits. This is provided as a Simple Reversionary Bonus that accrues during the premium paying term and is paid to the policyholder or nominee at the end of the term or death in addition to the final additional bonus.

ii. Final Addition Bonus: Paid if the policy has run for a minimum period. Final Additional Bonus may be declared when a claim is made either as a result of death or maturity, provided the policy has been in effect for a minimum term.

| Buying LIC Policy Online with LICNewPolicyOnline.com | Buying A Policy Offline visiting LIC branch or through an agent | ||

|---|---|---|---|

| Address Proof | Aadhar Zip File | Address Proof | Aadhar |

| ID Proof | ID Proof | Pan Card or Aadhar | |

| Age Proof | Age Proof | Aadhar / Driving License | |

| Income Proof | IT Returns of last 2 years | ||

| Photo | Passport Photo | ||

| Buying Online Policy with LICNewPolicyOnline.com | |

|---|---|

| Address Proof | Aadhar |

| ID Proof | |

| Age Proof | |

| Buying A Policy Offline visiting LIC branch or through an agent | |

|---|---|

| Address Proof | Aadhar |

| ID Proof | Pan Card or Aadhar |

| Age Proof | Aadhar / Driving License |

| Income Proof | IT Returns of last 2 years |

| Photo | Passport Photo |

1. Does jeevan tarun plan declared bonus in LIC?

Yes

2. Is Jeevan Tarun a money back policy?

Yes

3. What is the maturity amount of LIC Jeevan Tarun 834?

OPTION 1 - 100% of Sum assured + Bonus at child age 25 years

OPTION 2 - 75% of Sum assured + Bonus at child age 25 years

OPTION 3 - 50% of Sum assured + Bonus at child age 25 years

OPTION 4 - 15% of Sum assured + Bonus at child age 25 years

4. Can I surrender Jeevan Tarun policy?

Yes, you can surrender after 2 years from date of commencement.

5. Which policy is best in LIC for child?

The best LIC policy for a child depends on a variety of factors, that includes the age of the child, at what age money is required and child's future goals. Jeevan Tarun is the best child policy.

LIC Jeevan Tarun: This is a money-back policy for children. It provides financial protection and also gives money back on survival at specific intervals to take care of higher education and other needs of the child.

There are several LIC policies that are designed to provide financial protection for children.Some other popular options include:

LIC New Children's Money Back Policy: This policy is designed to provide financial protection for children and includes a maturity benefit, as well as regular money back payments to help cover the costs of the child's education and other expenses.

LIC Single premium Endowment plan LIC Endowment Plan: This is a Single premium plan, where a lumpsum amount is paid on Maturity.

LIC policyholders enjoy a sovereign guarantee on the sum assured and the bonus declared as per section 37 of LIC Act, 1956 which clearly states that "Policies to be guaranteed by Central Government - The sum assured by all policies issued by the corporation including any bonuses declared in respect thereof and, subject to the provisions contained in section 14 the amounts assured by all policies issued by any insurer the liabilities under which have vested in the corporation under this act, and all bonuses declared in respect thereof, whether before or after the appointed day, shall be guaranteed as to payment in cash by the Central Government."