Children grow quickly, and their needs evolve too. Smart financial planning for parents is vital, especially today. That’s where LIC comes in with the LIC New Children’s Money Back Plan lic new children’s money back plan online, safeguarding your child’s aspirations and your peace of mind.

The LIC New Children’s Money Back plan is a feature-packed insurance policy designed specifically for children. This online policy offers a range of benefits and features that make it an attractive option for parents looking to secure their child’s future.

As caring parents, we all share a common goal: to pave the way for our children’s success in the world that lies ahead. Introducing the remarkable LIC New Children’s Money Back Plan – a visionary solution designed to nurture your child’s aspirations. Crafted to cater to the diverse needs of growing children, from quality education to unforgettable weddings and beyond, this unique participating, non-linked money back scheme best money back policy offers a comprehensive safety net. With its dual benefits of survival benefits and risk cover, this plan ensures that you’re not only investing in their dreams, but also securing their future. Explore LIC’s best children’s plan investment lic jeevan tarun plan now and give your kids the head start they deserve.

One of the key benefits of buying this LIC policy online is the convenience it offers. Parents can easily purchase the policy and make premium payments online, saving them time and effort. The LIC New Children’s Money Back plan provides both a life insurance cover lic tax saving plan and a money back plan. In case of the unfortunate demise of the life assured, a sum assured on death is payable under the plan. Additionally, the plan offers survival benefits at different stages of the child’s life, providing financial support when it is needed the most. Maturity benefits are also available under the plan, ensuring that the child is financially secure in the long run. With flexible premium payment options and a wide range of benefits payable online, the LIC New Children’s Money Back plan is an ideal choice for parents who want to secure their child’s future.

Easily can buy online, focusing on premiums, children’s education, and security. Discover benefits and key features, or apply at your nearest LIC branch. Secure your child’s future now. Our online platform offers unparalleled convenience. Explore and compare plans from home, streamlining your decision to buy LIC plans. No more paperwork, saving time and effort for a hassle-free experience.

Invest in LIC’s New Children’s Money Back plan today. Give your child a strong start for a successful future with LIC’s child education plan. Hence, regular investments in LIC’s New Children’s Money Back Plan, the best children’s plan, can help you build a large sum over time and choose to get returns at important stages of your child’s life.

| Minimum age | 0 years |

| Maximum age | 12 years |

| Policy Term | 25 years minus Age at entry |

| Minimum Sum Assured | Rs. 1,00,000 |

| Maximum Sum Assured | No limit |

| Premium payment | Yearly / Half yearly / Quarterly / Monthly (Through Bank) |

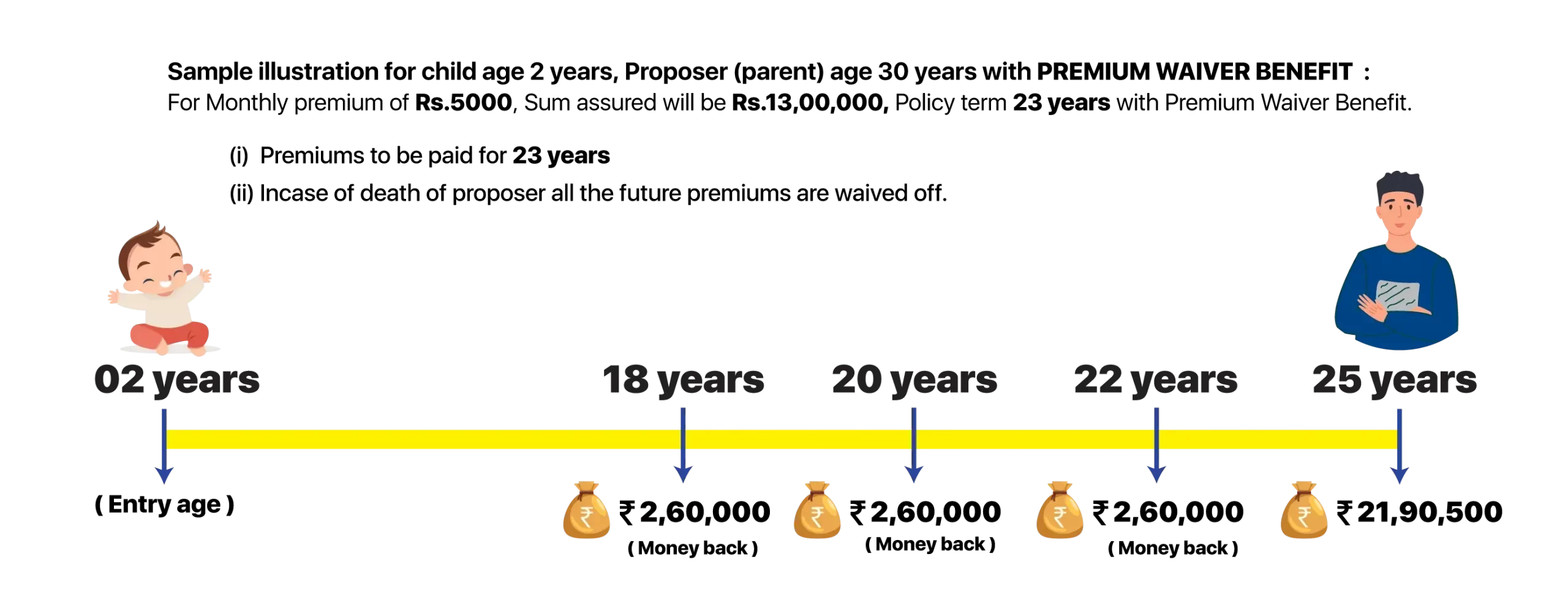

| Money back is paid | 18th year of child - 20% of Sum assured 20th year of child - 20% of Sum assured 22ndyearof child - 20% of Sum assured |

| Loan | Available after 2 years |

| Surrender | Available after 2 years |

| On maturity | 40% of the Sum assured + Bonus + Final bonus |

| Premium waiver benefit | Parent age must be between 18 to 55 years |

| Income Tax Benefits | (i) Premiums paid are eligible for Tax rebate u/s 80c (ii) Maturity amount / Death claim is non-taxable u/s 10(10d) |

This policy offers survival benefits to the policyholder, provided that they survive the policy term and pay all premiums on time. The benefits consist of a fixed percentage of the overall sum assured, which the policyholder will receive as they reach specific age milestones.

These age milestones and percentage payouts are outlined in the policy terms and apply for the duration of the policy.

The policyholder will receive the maturity benefit if the life assured survives the entire policy term and pays all premiums on time. The maturity benefit comprises 40% of the sum assured plus any accrued bonuses and is paid out at maturity. The policy then terminates.

The New Children’s Money Back Plan from LIC offers a Surrender Value feature, which entitles the policyholder to receive a certain percentage of the Premium Amount if they decide to surrender the policy after completing three policy years.

Furthermore, if the policyholder has paid the full premium amount for three years and the policy has acquired a surrender value, they can also be eligible for a loan.

In addition, as a policyholder, you are entitled to receive the profits of the insurance company through Simple Reversionary Bonus and Final Additional Bonus, which will be paid out at the time of policy maturity or as a death benefit. These bonuses will be declared by LIC.

Premiums paid for LIC New Children’s Money Back Plan are tax-free deductions under Section 80C, with a maximum deduction of INR 1.5 lakhs. Section 10(10D) allows inclusion of all benefits, including death and maturity benefits, without tax.

In case of the policyholder’s death during the policy term, the nominee receives the Sum Assured on Death along with bonuses declared.

LIC’s New Children’s Money Back Plan offers a premium waiver rider for proposers aged 18 to 55 years, where future premiums of the base plan are waived off if the proposer passes away during the active policy term.

i. Simple Reversionary Bonus: LIC declares an amount per thousand Sum Assured annually, forming part of guaranteed benefits. It accrues during the premium paying term and is paid to the policyholder/nominee at the end of the term or in case of death, along with the final additional bonus.

ii. Final Addition Bonus: Paid for policies with a minimum duration, the final additional bonus is declared upon death or maturity claims, given the policy has been in effect for a minimum term.

| Buying LIC Policy Online with LICNewPolicyOnline.com | Buying A Policy Offline visiting LIC branch or through an agent | ||

|---|---|---|---|

| Address Proof | Aadhar Zip File | Address Proof | Aadhar |

| ID Proof | ID Proof | Pan Card or Aadhar | |

| Age Proof | Age Proof | Aadhar / Driving License | |

| Income Proof | IT Returns of last 2 years | ||

| Photo | Passport Photo | ||

| Buying Online Policy with LICNewPolicyOnline.com | |

|---|---|

| Address Proof | Aadhar |

| ID Proof | |

| Age Proof | |

| Buying A Policy Offline visiting LIC branch or through an agent | |

|---|---|

| Address Proof | Aadhar |

| ID Proof | Pan Card or Aadhar |

| Age Proof | Aadhar / Driving License |

| Income Proof | IT Returns of last 2 years |

| Photo | Passport Photo |

1. How LIC money back policy maturity amount is calculated?

Money back is paid at the stipulated fixed intervals as mentioned in the policy conditions

2. How is vested bonus calculated in LIC money back policy?

Vested bonus How does LIC calculate bonus? will be declared by LIC from time to time

3. premium waiver benefit in LIC New Children’s Money Back plan?

Yes Premium Waiver benefit can be availed under New Children's money back plan

4. What is 834 plan in LIC?

Plan no, 834 is a discontinued plan from LIC.

5. Maturity Benefit of LIC’s New Children’s Money Back Plan?

Maturity benefit LIC Children's Money Back Plan Benefits under Children's money back plan is paid at child age 25 years

6. Survival Benefit of LIC’s New Children’s Money Back Plan?

Survival benefit is paid at child age 18 yrs, 20 yrs & 22nd year

7. Can I get loan on LIC’s New Children’s Money Back Plan?

Yes, Loan can be availed two years after the policy commencement date.

8. Which is the best lic policy for new born baby?

Some popular options offered by Life Insurance Corporation of India (LIC) for a newborn baby include:

LIC New Children's Money Back Plan: A participating non-linked money back plan that provides periodic payment of survival benefits and a lump sum payment on maturity. LIC Jeevan Tarun Plan: A participating, non-linked, with-profits endowment plan that provides for risk coverage and savings. LIC Jeevan Tarun is the best child plan for new born baby.

9. Difference between LIC new children's money back plan vs LIC Jeevan Tarun?

LIC New Children's Money Back Plan and LIC Jeevan Tarun are both life insurance plans offered by Life Insurance Corporation of India (LIC) that cater to the needs of parents for securing the future of their children.

LIC New Children's Money Back Plan is a participating non-linked money back plan which provides for periodic payment of survival benefits during the policy term and a lump sum payment on maturity.

LIC Jeevan Tarun Plan is a participating, non-linked, with-profits endowment plan which provides for risk coverage and savings. The policy offers financial protection to the child, in case of the unfortunate event of death of the parent.

Ultimately, the choice between the two plans will depend on your specific financial goals and risk tolerance.

LIC policyholders enjoy a sovereign guarantee on the sum assured and the bonus declared as per section 37 of LIC Act, 1956 which clearly states that "Policies to be guaranteed by Central Government - The sum assured by all policies issued by the corporation including any bonuses declared in respect thereof and, subject to the provisions contained in section 14 the amounts assured by all policies issued by any insurer the liabilities under which have vested in the corporation under this act, and all bonuses declared in respect thereof, whether before or after the appointed day, shall be guaranteed as to payment in cash by the Central Government."