Don’t leave anything to chance, Get insured and protect your loved ones by choice.

The simplest and purest form of LIC term insurance is Term plan. LIC offers LIC JEEVAN AMAR LIC Jeevan Amar term plan a pure protection plan at a very affordable price and ensures financial support for the family in case of unfortunate death of the policyholder during the policy term.

You can get a higher insurance cover at a relatively low premium. A complete financial security to your loved ones.

LIC Jeevan Amar plan LIC Jeevan Amar Plan Eligibility has wide range of flexibility to choose under a single plan ie., option to pay One-time premium or regular premium, again regular premium can be paid for full policy term or lesser than policy term. Can choose to have fixed coverage or Increasing coverage year on year, Lesser premium Non-Smoker & female lives

| Minimum age | 18 years (Completed) |

| Maximum age | 65 years |

| Maximum maturity age | 80 years |

| Minimum Sum Assured | Rs. 25 Lakhs |

| Maximum Sum Assured | No upper limit |

| Policy Term | 10 to 40years |

| Premium paying term | Single premium, Regular premium, Limited premium (Policy term minus 5 or 10 years) |

| Loan | Not available |

| Surrender | Not applicable |

| On Death | Sum Assured + Accidental risk cover |

| On Maturity | NIL |

| Income Tax Benefits | (i) Premiums paid are eligible for Tax rebate u/s 80c (ii) Maturity amount / Death claim is Non-taxable u/s 10(10d) |

Benefits of Jeevan Amar Policy

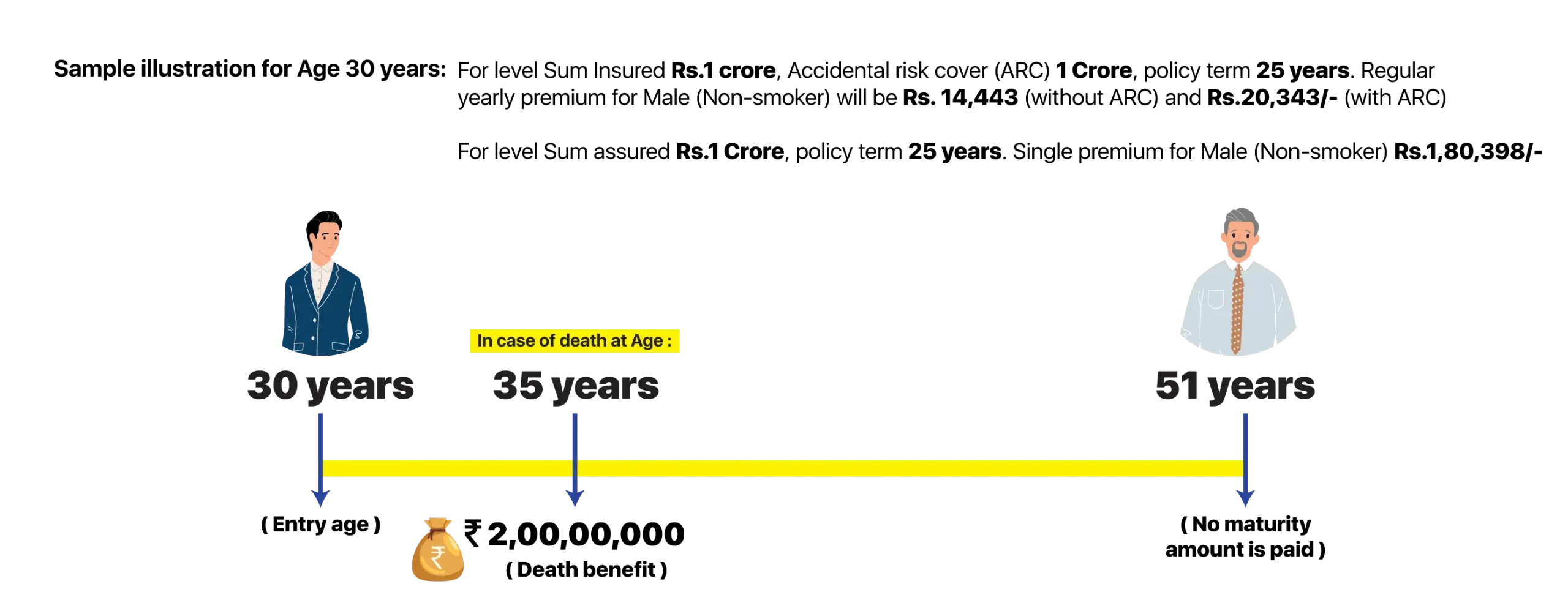

Benefits of Jeevan Amar Policy In LIC Jeevan Amar, the death benefit payable to the nominee of the policy holder can be availed under two options, Level Sum Assured and Increasing Sum Assured.

i. Level Sum Assured

The sum assured payable on death remains the same throughout the policy term

ii. Increasing Sum Assured

The sum assured payable on death remains constant for the first 5 years of the policy term. This amount increases by 10% from the 6th year till the 15th year. Thereafter the sum assured remains constant till the balance of the policy term.

The death benefit amount is calculated as the higher of the following depending on the policy paying option

Single Premium Payment

Regular & Limited Premium

By paying an additional premium amount as Accident Benefit Rider, wherein Upon the policyholder’s demise resulting from an accident, the nominee will receive an extra amount as part of the Accident Benefit Rider, which is added to the Absolute Sum Assured.

While opting for the policy, the policy holder can choose to have the death benefit payable to the nominee as a lumpsum amount or as Instalment pay-outs.

i. Lumpsum Pay-out – In this option, the entire death benefit payable as Sum Assured will be paid at one go

ii. Instalment Pay-outs – The policy holder can opt to receive the death benefit part in lumpsum and balance in instalments over a period of 5, 10 or 15 years.

There is no maturity benefit available in this plan.

There is no surrender value of LIC Jeevan Amar policy in the case of regular premium payment. However, an applicable refund amount will be processed at any time during the policy tenure in case of single premium payment.

Under Section 80C of the Income Tax Act, the premiums paid for LIC Jeevan Amar Buy LIC Jeevan Amar Policy are eligible for a tax-free deduction. Individuals can claim a maximum deduction of INR 1.5 lakhs on this amount.

In the event of the policyholder’s death during the policy term, the nominee will be entitled to receive the death benefit as the Sum Assured either in Lumpsum in a single-go or as instalments over a period of 5, 10 or 15 years.

With this rider, the policy holder gets access to a lump-sum pay out in case of accidental death in addition to the Sum Assured death benefit. In order to avail the life insurance policy rider, one must pay an additional premium.

| Buying LIC Policy Online with LICNewPolicyOnline.com | Buying A Policy Offline visiting LIC branch or through an agent | ||

|---|---|---|---|

| Address Proof | Aadhar Zip File | Address Proof | Aadhar |

| ID Proof | ID Proof | Pan Card or Aadhar | |

| Age Proof | Age Proof | Aadhar / Driving License | |

| Income Proof | IT Returns of last 2 years | ||

| Photo | Passport Photo | ||

| Buying Online Policy with LICNewPolicyOnline.com | |

|---|---|

| Address Proof | Aadhar |

| ID Proof | |

| Age Proof | |

| Buying A Policy Offline visiting LIC branch or through an agent | |

|---|---|

| Address Proof | Aadhar |

| ID Proof | Pan Card or Aadhar |

| Age Proof | Aadhar / Driving License |

| Income Proof | IT Returns of last 2 years |

| Photo | Passport Photo |

1. What is accident benefits in Jeevan Amar?

The LIC Jeevan Amar plan offers accident benefit, Jeevan Amar Accident Benefits which provide financial protection in the event of an accident-related death or permanent disability. In the event of an accident-related death or permanent disability, regardless of the cause, this benefit pays a lump sum to the policyholder or their nominee.

2. Which is the best LIC Tech term or LIC Jeevan Amar?

It's not possible to determine which is "best" as both LIC Tech term LIC Term Policy Online and LIC Jeevan Amar are life insurance policies offered by Life Insurance Corporation of India (LIC), and the choice between the two depends on individual needs and financial goals.It's advisable to consult a financial advisor for personalized advice.

3. What is the policy term for Jeevan Amar policy?

Minimum policy term is 10 years and maximum 40 years

4. Can I take Jeevan Amar online?

Yes

5. What is death SA option?

Under this option, Death benefit LIC Jeevan Amar Plan Benefits amount can be taken either in one Lumpsum or in equal instalments of 5/ 10/ 15 years

6. Is medical test required for LIC Jeevan Amar?

Yes, medical tests are compulsory for LIC Jeevan Amar irrespective of age and coverage. The policyholder is required to undergo a medical test prior to taking this policy at the authorized LIC medical center nearest to your place for free of cost.

7. Which death is not covered in term insurance?

All death is covered under term insurance

8. What is the surrender value of LIC Jeevan Amar policy?

LIC Jeevan Amar is a non-linked, non-participating, pure protection plan, which means it provides only life coverage and does not have any savings component. As a result, there is no surrender value paid in this policy.

9. Is there any grace period to pay the premium of LIC Jeevan Amar policy?

Yes, there is a grace period for payment of premium in LIC Jeevan Amar policy. The grace period is usually a 14-day period from the due date of premium payment. However, it is important to note that the details of the grace period may vary depending on the policy terms and conditions. It is advisable to check the policy document or contact the LIC customer service for more information.

What are the documents required for LIC Jeevan Amar Policy?

The following are the commonly required documents for purchasing a LIC Jeevan Amar Plan:

LIC policyholders enjoy a sovereign guarantee on the sum assured and the bonus declared as per section 37 of LIC Act, 1956 which clearly states that "Policies to be guaranteed by Central Government - The sum assured by all policies issued by the corporation including any bonuses declared in respect thereof and, subject to the provisions contained in section 14 the amounts assured by all policies issued by any insurer the liabilities under which have vested in the corporation under this act, and all bonuses declared in respect thereof, whether before or after the appointed day, shall be guaranteed as to payment in cash by the Central Government."