Missed retirement planning Buy LIC Jeevan Shanti Online?

No worries, here’s your chance!!!

Pay Once & Get Guaranteed Income For Lifetime and live comfortably even beyond your working years!

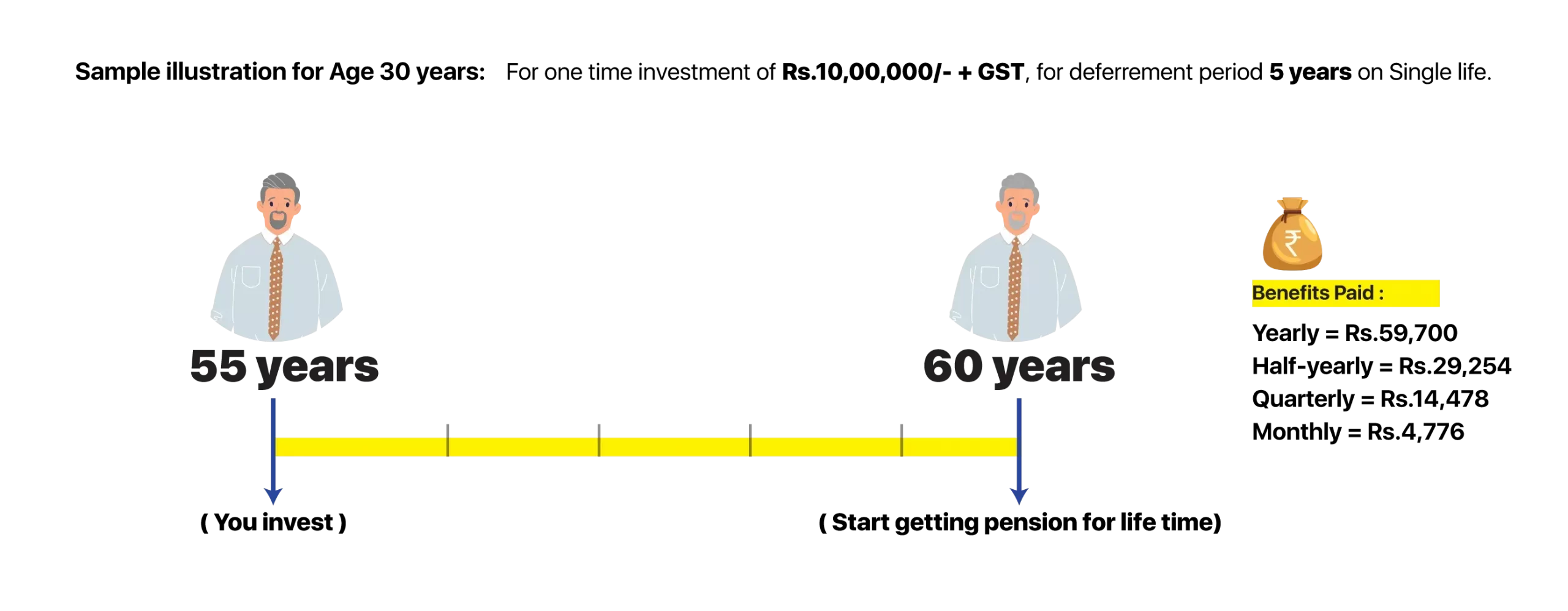

Plan your best for the second innings of life by Investing in LIC JEEVAN SHANTHI Plan a Single premium pension plan and make your retirement special with regular guaranteed income for your lifetime also pension continues in your absence for your family member (can choose your Parents/ Spouse/ Children/ Grandchildren/ Siblings as joint life). Option to choose pension date i.e., the deferred period available from 1 to 12 years (higher the deferred period, higher the pension)

If you’re looking for an investment that will help secure your retirement, the LIC Jeevan Shanti Plan may be a good option for you. Here, we’ve listed out the most important aspects of the plan so you can make an informed decision.

Be sure to read about the features and benefits of LIC Jeevan Shanti policy, as well as more information about annuity options and tax benefits of LIC Jeevan Shanti LIC Jeevan Shanti Tax Benefit

Get started today to ensure a bright future!

| Minimum age | 30 years |

| Maximum age | 79 years |

| Premium mode | Single Premium |

| Annuity Mode | Yearly / Half yearly / Quarterly / Monthly |

| Premium | Minimum. Rs.1,50,000 Maximum. No limit |

| Loan | Eligible after 3 months |

| Surrender | Allowed after 3 months |

| Income Tax Benefits | Premiums paid is eligible for Tax rebate u/s 80c Pension is taxable |

| ANNUITY OPTIONS: | a) Single life b) Joint life |

| Differed period | 1 to 12 years |

LIC Jeevan Shanti Plan’s Annuity Options

This plan provides 2 different options to the insured wherein he can opt for an insurance cover using a single premium and then opt for returns in the form of annuity payments that can be used as retirement income. The first option being an Immediate annuity plan, under which a total of 10 options to receive the annuity pay-outs. On the other hand, within a deferred annuity plan, there are two options are available that provide adequate cover against any risk one might encounter in life.

i. Immediate Annuity

| Options | Annuity Pay-outs |

|---|---|

| Option A | Immediate Annuity for life |

| Option B | Immediate Annuity with guaranteed period of 5 years and life thereafter |

| Option C | Immediate Annuity with guaranteed period of 10 years and life thereafter. |

| Option D | Immediate Annuity with guaranteed period of 15 years and life thereafter. |

| Option E | Immediate Annuity with guaranteed period of 20 years and life thereafter. |

| Option F | Immediate Annuity for life with Return of Purchase Price. |

| Option G | Immediate Annuity for life increasing at a simple rate of 3% p.a. |

| Option H | Joint Life Immediate Annuity for life with a provision for 50% of the annuity to the Secondary Annuitant on death of the Primary Annuitant. |

| Option I | Joint Life Immediate Annuity for life with a provision for 100% of the annuity payable as long as one of the Annuitant survives. |

| Option J | Joint Life Immediate Annuity for life with a provision for 100% of the annuity payable as long as one of the Annuitant survives and return of Purchase Price on death of last survivor. |

ii. Deferred Annuity

| Options | Annuity Pay-outs |

|---|---|

| Option A | Deferred annuity for Single life |

| Option B | Deferred annuity for Joint life |

Benefit payable is applicable only for Deferred Annuity. In the event of the policy holder’s demise within the policy tenure the Sum Assured on Death along with the accrued Bonuses would be payable to the nominee.

The Sum Assured on Death is higher of the following:

The death benefit can be received in the following options:

i. Lump-Sum

The death benefit can be received in the form of a lump sum amount

ii. Annuity

On the death of the insured, the benefit would be utilized to buy an Immediate Annuity for the nominees, depending on the age of the nominee

In this plan, there is no benefit available upon maturity.

The policy can be surrendered at any time after three months from purchase. With an Immediate Annuity, the surrender value is available only with options F & J. In the Deferred Annuity plan, the surrender value is applicable for both the options.

The charges paid towards purchasing LIC Jeevan Shanti Plan is considered as a tax-exempt derivation under Segment 80C of the Personal Expense Act. One can guarantee a most extreme derivation of INR 1.5 lakhs on this sum.

| Buying LIC Policy Online with LICNewPolicyOnline.com | Buying A Policy Offline visiting LIC branch or through an agent | ||

|---|---|---|---|

| Address Proof | Aadhar Zip File | Address Proof | Aadhar |

| ID Proof | ID Proof | Pan Card or Aadhar | |

| Age Proof | Age Proof | Aadhar / Driving License | |

| Income Proof | IT Returns of last 2 years | ||

| Photo | Passport Photo | ||

| Buying Online Policy with LICNewPolicyOnline.com | |

|---|---|

| Address Proof | Aadhar |

| ID Proof | |

| Age Proof | |

| Buying A Policy Offline visiting LIC branch or through an agent | |

|---|---|

| Address Proof | Aadhar |

| ID Proof | Pan Card or Aadhar |

| Age Proof | Aadhar / Driving License |

| Income Proof | IT Returns of last 2 years |

| Photo | Passport Photo |

1. What is the interest rate for LIC Jeevan Shanti?

In Jeevan Shanti interest rateHow does LIC Jeevan Shanti work? depends on the age of the policy holder (higher the age, higher the interest rate) also Interest rate depends on deferred years (higher the deferred year. higher the interest rate)

2. Can I withdraw LIC Jeevan Shanti?

Yes, you can surrender Surrender Value of Jeevan Shanti after 3 months from the date of commencement of the policy

3. Which is better Jeevan Shanti or Jeevan Akshay?

Jeevan AkshayLIC Jeevan Akshay is immediate annuity plan and Jeevan Shanti is deferred annuity plan. Jeevan Akshay is a better option for people who want to start receiving their pension as soon as they purchase the policy. LIC Jeevan Shanti, on the other hand, might be a better choice for people who want to save money over time in order to receive a higher pension in the future.

4. Can Jeevan Shanti be assigned?

No

5. What are the minimum and maximum deferment period under Jeevan Shanti plan?

Minimum deferred period is 1 year and maximum 12 years

6. Is pension from Jeevan Shanti taxable?

Yes, pension is taxable as per your income slab

7. What is guaranteed addition in Jeevan Shanti?

The interest rates are set and remain fixed from the beginning of the policy.

8. Is LIC Jeevan Shanti eligible for 80C?

Yes, Premiums paid under Jeevan Shanti are eligible for tax benefit under Income tax Section 80C tax. 10℅ of Premium is eligible under sec 80C. This plan provides a guaranteed pension for the lifetime of the policyholder.

9. Is Jeevan Shanti annuity taxable?

Yes, Jeevan Shanti annuity is taxable. The pension amount paid in this plan will be added to your taxable income.

10. What is the surrender value of Jeevan Shanti?

The policy can be surrendered at any time after 3 months from the completion of the policy. Surrender value depends at the age of the annuitant.

You should consult with a financial advisor before making a decision to surrender your policy, as it may be more beneficial to keep the policy in force instead of surrendering it.

LIC policyholders enjoy a sovereign guarantee on the sum assured and the bonus declared as per section 37 of LIC Act, 1956 which clearly states that "Policies to be guaranteed by Central Government - The sum assured by all policies issued by the corporation including any bonuses declared in respect thereof and, subject to the provisions contained in section 14 the amounts assured by all policies issued by any insurer the liabilities under which have vested in the corporation under this act, and all bonuses declared in respect thereof, whether before or after the appointed day, shall be guaranteed as to payment in cash by the Central Government."