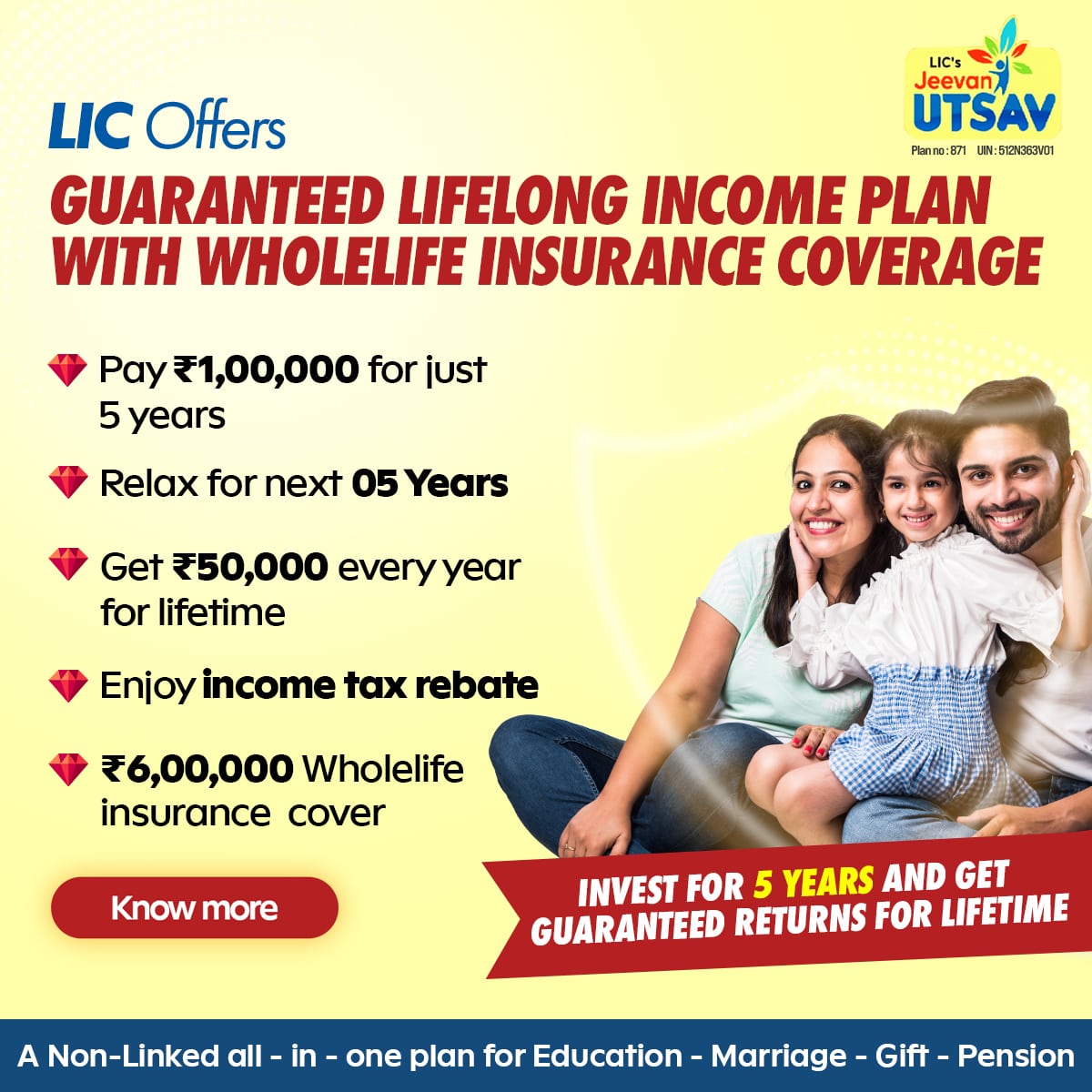

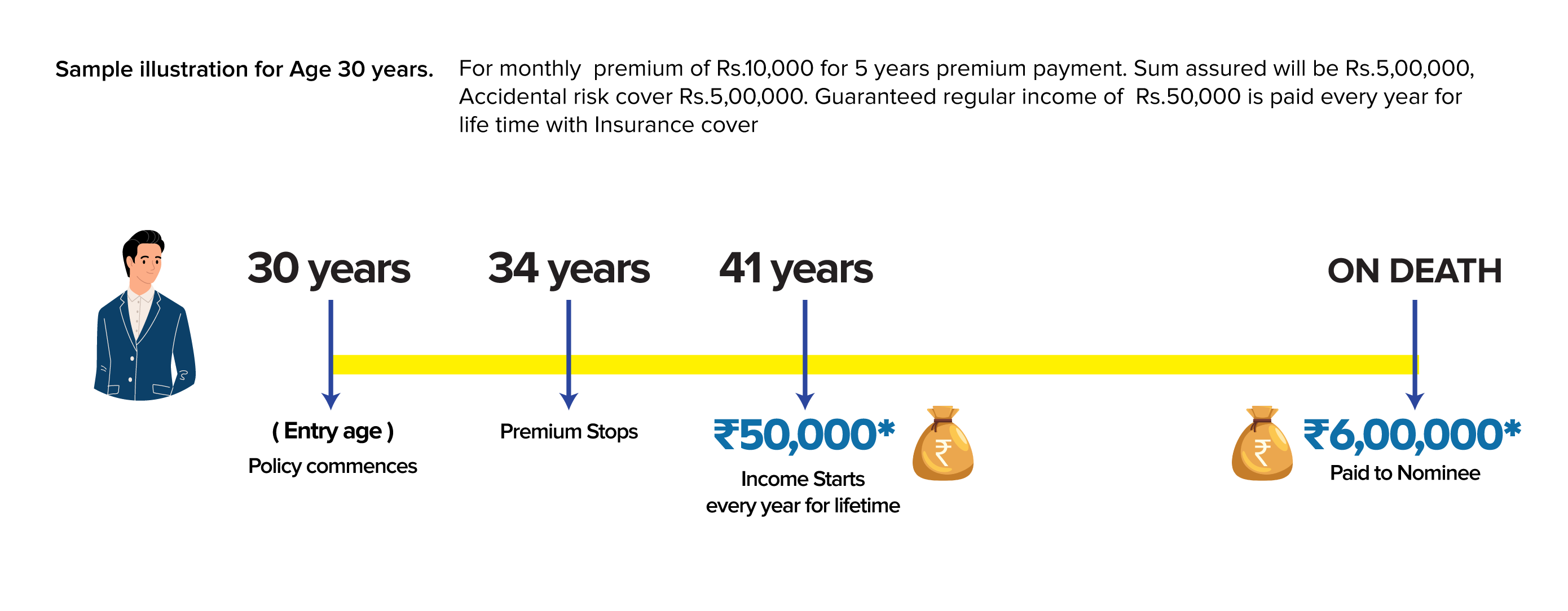

Introducing 'Jeevan Utsav' by the Life Insurance Corporation of India (LIC), an innovative non-linked, non-participating money-back life insurance product designed to provide steady lifetime guaranteed returns This unique policy offers a guaranteed 10 percent of the sum assured every year for lifetime with Insurance coverage for whole life.

With a minimum sum assured of Rs 5 lakh and flexible premium paying terms spanning from five to 16 years, 'Jeevan Utsav' caters to a wide spectrum of individuals. Entry is open for those aged eight and extends up to 65 years, ensuring inclusivity across various age groups.

This policy offers versatile payout options – regular income and flexi income benefits. The survival benefits, a key highlight, commence after specific policy periods depending on the chosen premium paying term. Notably, senior citizens can enjoy guaranteed income for life through this policy. Additionally, an annual increment of Rs 40,000 of the basic sum assured during the premium-paying period further enhances the overall benefits and financial security offered by 'Jeevan Utsav'.

| Minimum age | 90 days (Completed) |

| Maximum age | 65 years |

| Premium paying term | 5 to 16 years |

| Income starts from | For 5 to 8 years payment, Income from 10 year 9 to 16 years, Income from 11 to 18 years (premium paymnent +2 years) |

| Income is paid | For Whole life |

| Minimum Sum Assured | Rs.5,00,000 |

| Maximum Sum Assured | No limit |

| Premium Payment | Yearly / Half yearly / Quarterly / Monthly (ECS) |

| Loan | Eligible after 2 years |

| Surrender | Eligible after 2 years |

| Income paid | 10% of Sum Assured is paid every year for whole life |

| On Death | Sum Assured + Guaranteed addition is payable |

| Income Tax Benefits |

|

In case of death during the policy term, provided the policy is in force ‘Sum Assured on Death’ shall be payable along with the accrued guaranteed additions

For policyholders who successfully complete the payment term of the policy, there exist two alternatives to receive survival benefits:

This choice ensures that the policyholder receives 10 percent of the basic sum assured annually. The initiation of payments is contingent upon the selected premium payment term, offering a deferment window spanning from three to six years. For instance, with a premium payment term of five years, the survival benefit will commence from the 11th policy year, while for a term of 16 years, it begins from the 19th policy year.

Similar to the regular income option, this flexible alternative also guarantees 10 percent of the basic sum assured annually. The deferment period aligns with the regular income option, but policyholders have the flexibility to further postpone it. If left unclaimed, the accrued amount earns an annual interest of 5.5 percent compounded yearly until withdrawal, policy surrender, or in the event of death. Policyholders can withdraw up to 75 percent of the accumulated balance annually, including interest, while the remaining amount continues to accumulate interest.

The policy offers a tax benefit wherein the premium deposited, up to Rs 1.5 lakh per financial year, qualifies for exemption under section 80C of the Income Tax Act. Additionally, the maturity amount, which is ten times the annual premium, is also exempt from taxes under section 10(10D).

Surrender value and paid-up value available after 2 years of premium payment

Policy holder can avail loan on the policy after two years with full premiums paid

1. Accidental death and disability rider benefit

Suppose this rider has opted in case of accidental death of policyholder, the accident benefit sum

assured will be payable in lumpsum along with the death benefits of the base plan

2. New Term Assurance rider

New Term assurance rider available where amount equal to rider including base death benefit paid to policy holder

3. Critical illness benefit rider

If rider is opted for; critical illness benefits are payable on the first diagnosis specified under the rider. 15 critical illnesses are covered under this rider benefit

4. Premium payment waiver rider

If opted for this rider, all the future due premiums payments under the base policy will be waived off following the eligible proposer's death.

| Buying LIC Policy Online with LICNewPolicyOnline.com | Buying A Policy Offline visiting LIC branch or through an agent | ||

|---|---|---|---|

| Address Proof | Aadhar Zip File | Address Proof | Aadhar |

| ID Proof | ID Proof | Pan Card or Aadhar | |

| Age Proof | Age Proof | Aadhar / Driving License | |

| Income Proof | IT Returns of last 2 years | ||

| Photo | Passport Photo | ||

| Buying Online Policy with LICNewPolicyOnline.com | |

|---|---|

| Address Proof | Aadhar |

| ID Proof | |

| Age Proof | |

| Buying A Policy Offline visiting LIC branch or through an agent | |

|---|---|

| Address Proof | Aadhar |

| ID Proof | Pan Card or Aadhar |

| Age Proof | Aadhar / Driving License |

| Income Proof | IT Returns of last 2 years |

| Photo | Passport Photo |

LIC policyholders enjoy a sovereign guarantee on the sum assured and the bonus declared as per section 37 of LIC Act, 1956 which clearly states that "Policies to be guaranteed by Central Government - The sum assured by all policies issued by the corporation including any bonuses declared in respect thereof and, subject to the provisions contained in section 14 the amounts assured by all policies issued by any insurer the liabilities under which have vested in the corporation under this act, and all bonuses declared in respect thereof, whether before or after the appointed day, shall be guaranteed as to payment in cash by the Central Government."