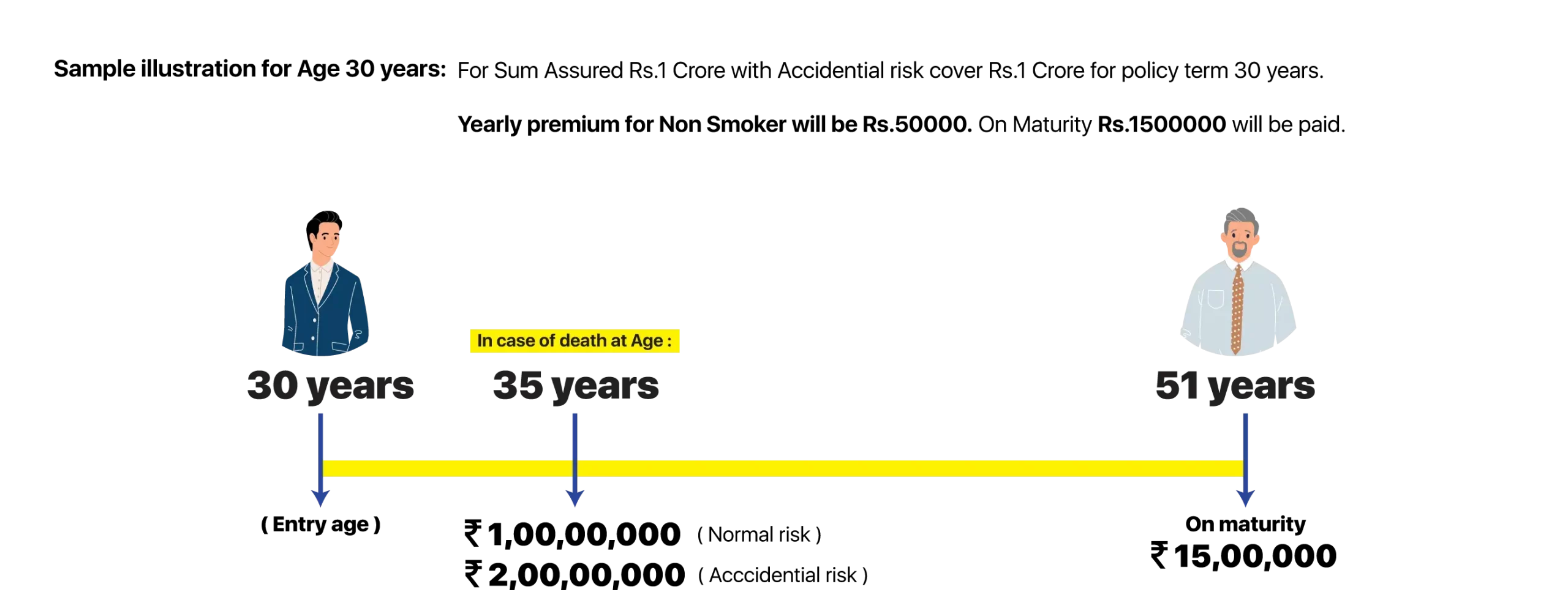

Introducing LIC’s latest offering – the Jeevan Kiran Term Insurance with Money Back Plan. This is not just an insurance plan, but a holistic solution that blends protection with savings. Designed to be a pillar of financial security, this plan ensures that your family receives the necessary support in the event of an unforeseen demise during the policy term. If the policy holder survives the policy term, the premiums are paid back to the policy holder. It’s more than just a plan; it’s peace of mind.

| Minimum Age at Entry | 18 years (last birthday) |

| Maximum Age at Entry | 65 years (last birthday) |

| Minimum Age at Maturity | 28 years (last birthday) |

| Maximum Age at Maturity | 80 years (last birthday) |

| Policy Term | 10 years to 40 years |

Premium Payment Term

|

|

| Minimum Basic Sum Assured | Rs. 15,00,000/- |

| Maximum Basic Sum Assured: No limits, subject to underwriting decision* | The maximum Basic Sum Assured allowed to each individual will be subject to underwriting decision as per the Board Approved Underwriting Policy. |

Benefits of LIC Jeevan Kiran Term Insurance

Benefits of LIC Jeevan Kiran Term Insurance In case of death during the policy term, provided the policy is in force ‘Sum Assured on Death’ shall be payable which will be:-

On life assured surviving date of maturity provided policy is in force, this term assurance plan allows refund of total premiums paid/single premium paid excluding any extra premium, any rider premium and taxes paid.

The policy offers a tax benefit wherein the premium deposited, up to Rs 1.5 lakh per financial year, qualifies for exemption under section 80C of the Income Tax Act. Additionally, the maturity amount, which is ten times the annual premium, is also exempt from taxes under section 10(10D).

Surrender value and paid-up value available after 2 years of premium payment

i. Accidental death and disability rider benefit

In the Jeevan Kiran Plan, the accidental death and disability rider provides a lump-sum accidental rider benefit sum assured to the beneficiary upon accidental demise of the insured, alongside the base plan’s death benefit. Likewise, accidental disability entitles the insured to receive the accidental rider benefit sum assured in equal monthly instalments for 10 years, while waiving all current and future premiums.

ii. Accident Benefit Rider

If this rider is opted for, in case of accidental death, the Accident Benefit Sum Assured will be payable in lumpsum along with the death benefit under the base plan.

| Buying LIC Policy Online with LICNewPolicyOnline.com | Buying A Policy Offline visiting LIC branch or through an agent | ||

|---|---|---|---|

| Address Proof | Aadhar Zip File | Address Proof | Aadhar |

| ID Proof | ID Proof | Pan Card or Aadhar | |

| Age Proof | Age Proof | Aadhar / Driving License | |

| Income Proof | IT Returns of last 2 years | ||

| Photo | Passport Photo | ||

| Buying Online Policy with LICNewPolicyOnline.com | |

|---|---|

| Address Proof | Aadhar |

| ID Proof | |

| Age Proof | |

| Buying A Policy Offline visiting LIC branch or through an agent | |

|---|---|

| Address Proof | Aadhar |

| ID Proof | Pan Card or Aadhar |

| Age Proof | Aadhar / Driving License |

| Income Proof | IT Returns of last 2 years |

| Photo | Passport Photo |

1. Why should one consider the Jeevan Kiran plan number 870 of LIC ?

LIC's Jeevan Kiran stands as one of the premier Term Insurance Plans, assuring a guaranteed refund of money upon maturity. For those seeking substantial insurance coverage coupled with an assured refund of the premium upon maturity, LIC's Jeevan Kiran presents itself as the ultimate choice.

2. What are the advantages of term life insurance?

On average, life insurance rates are more affordable for term than whole life insurance because term policies offer coverage for a predetermined time. You get the safety of insurance for your family in your absence. In this policy, you get the third benefit of getting back the premiums paid, if you survive the policy term.

3. How many years is best for term insurance?

If you're currently in your 20s, select at least a 40-year term or opt for coverage until the age of 99. You should opt for a long tenure since you can make the most of affordable premiums without having to renew the plan.

LIC policyholders enjoy a sovereign guarantee on the sum assured and the bonus declared as per section 37 of LIC Act, 1956 which clearly states that "Policies to be guaranteed by Central Government - The sum assured by all policies issued by the corporation including any bonuses declared in respect thereof and, subject to the provisions contained in section 14 the amounts assured by all policies issued by any insurer the liabilities under which have vested in the corporation under this act, and all bonuses declared in respect thereof, whether before or after the appointed day, shall be guaranteed as to payment in cash by the Central Government."