February 22nd, 2023

licnewadmin

Whatever is your needs, Wherever you are. LIC has a Life Insurance plan for you. LIC is no. 1 Life Insurance provider in India and is trusted by millions for generations. Now you can buy the most popular LIC policies online. While purchasing insurance online, one of the most important aspects you should take into consideration is the Credibility of the insurance provider.

LIC is one of the oldest and most trusted names in insurance in India. When it comes to choosing a life insurance company, LIC is a name that needs no introduction. LIC is not just one of the largest insurance companies in India. It’s not just people from India who know about LIC. It’s a name that has been globally recognized for providing insurance and pension products.

LIC has its headquarters in Mumbai and was established in the year 1956 and it’s current Chairman is Shri.M.R.Kumar. The primary objective of LIC is to offer citizens a level of economic security that is superior to that offered by other investment firms in the market, allowing them to lead exceptional lives and contribute to economic growth. LIC’s motto is “Yogakshemam Vahamyaham,” which translates to “Your welfare is our responsibility.” The company is wholly owned by the Government of India.

Branches Of LIC In India:

Today, there are 2048 fully computerized branch offices, 113 divisional offices, 8 zonal offices, 1381 satellite offices, and the corporate office for LIC. The 113 divisional offices of LIC are covered by the Wide Area Network, which connects all of the branches via a Metro Area Network. In order to provide an online premium collection service in a few cities, LIC has partnered with a few banks and service providers. Numerous cities, including Mumbai, Ahmedabad, Bangalore, Chennai, Hyderabad, Kolkata, and New Delhi, have commissioned info centers.The digitalized records of the satellite offices will facilitate anywhere servicing. This means that no matter where you are in the world, you can always access your records and get the assistance you need from LIC.

Objectives of LIC

LIC offers a variety of products and services to its customers. Some of the main objectives of LIC include:

LIC also offers a number of other benefits and services, such as:

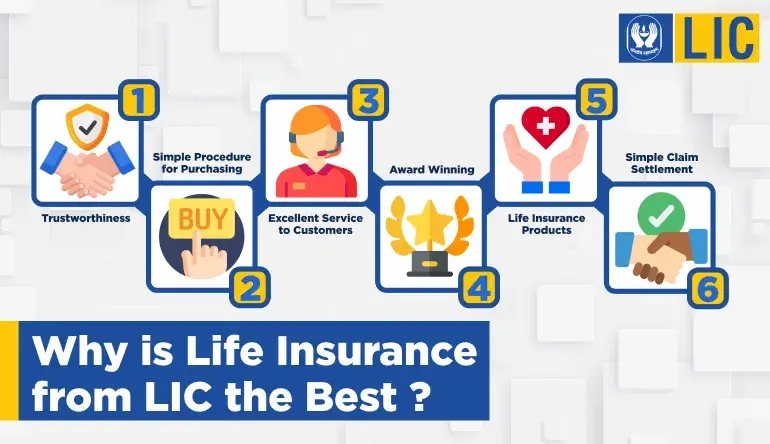

Why is Life Insurance from LIC the Best ?

Life Insurance Corporation of India (LIC) is one of the largest and most trusted life insurance companies in India, providing a wide range of insurance products to its customers. However, whether LIC’s life insurance policies are “the best” for an individual depends on their specific needs and financial goals.

Here are some reasons why Life Insurance from LIC is considered one of the best.

LIC’s policies are very flexible and based on customer’s requirements. It is a government-owned company, which leads to an increase in customer satisfaction levels. In fact, LIC has more than 30 Crore policyholders – equivalent to the fourth largest country in the world. Therefore, it is not only beneficial but better than other insurance companies when it comes to products and services.

Overview of Life Insurance Corporation of India (LIC) in numbers

| Parameters | Details |

|---|---|

| Total Policy Holders | 30 Crore |

| Claim Settlement Ratio | 99% |

| Solvency Margin | 160% |

| Paid | 31000 Crore to Govt. as Dividend |

| Asset Base | 42,30,617 Cr |

| AUM | 41.66 lakh Crore |

| Surplus Generator | 4-5 Lakh Crore Every year |

| No. of Branches | 2048- India 14- Abroad |

Buying LIC Insurance policies online and making online payment is possible now !

Coming to buying Life Insurance policies online, LIC is also making rapid strides to make its policies digitally available for anyone who is comfortable using the internet. By visiting the online LIC website, one can get all the information, compare plans and choose the best policy that meets your requirements. Customers can visit the LIC website, select the “Buy Online” option, and fill out a few details to get a quote for the desired policy. The quote will include the premium amount and terms and conditions. The policy can then be purchased online using a secure payment gateway and the policy document will be sent via email. Customers can contact LIC customer service for support with the process. If you have any questions, you can fill in an online form to get an immediate response to help you with all your queries on buying the best LIC Insurance policy.

When applying for an LIC policy, you will be required to submit the following documents:

| BUY LIC POLICY ONLINE With https://www.licnewpolicyonline.com/ |

BUY LIC PLAN OFFLINE Visiting LIC branch or through agent |

||

|---|---|---|---|

| Address Proof | Aadhar Zip File | Income Proof | IT Returns of last 2 years |

| ID Proof | ID Proof | Pan Card or Aadhar | |

| Age Proof | Age Proof | Aadhar / Driving License | |

| Photo | Passport Photo | ||

Conclusion

LIC’s mission is to provide life insurance and financial services in an efficient and cost-effective manner and to help people secure their future. It has been instrumental in providing financial security to millions of people in India and continues to spread the message of insurance across the nation.

The company offers a wide range of life insurance policies that can be customized to meet the specific needs of individual policyholders. This level of flexibility is a significant benefit, as it allows customers to choose coverage that is tailored to their unique financial goals and circumstances. Additionally, the large branch network of LIC makes it easy for customers to access its services, making the process of obtaining and maintaining life insurance coverage as convenient as possible. Overall, these factors, combined with its strong financial stability, make LIC an attractive option for Life Insurance coverage.

LIC policyholders enjoy a sovereign guarantee on the sum assured and the bonus declared as per section 37 of LIC Act, 1956 which clearly states that "Policies to be guaranteed by Central Government - The sum assured by all policies issued by the corporation including any bonuses declared in respect thereof and, subject to the provisions contained in section 14 the amounts assured by all policies issued by any insurer the liabilities under which have vested in the corporation under this act, and all bonuses declared in respect thereof, whether before or after the appointed day, shall be guaranteed as to payment in cash by the Central Government."