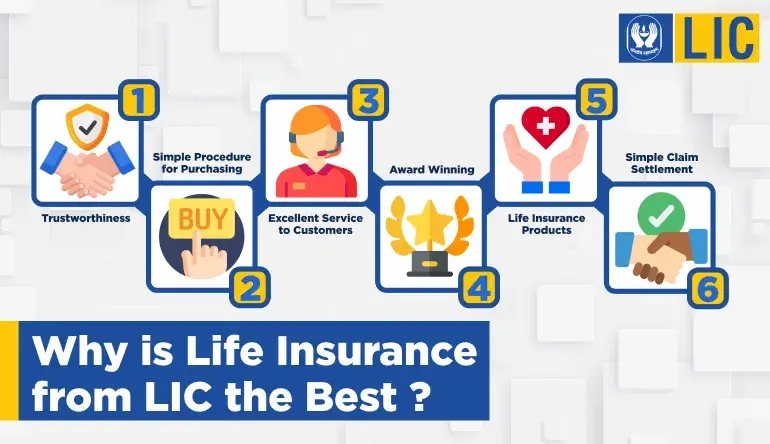

Buy LIC Term Insurance Plan Online

LIC Term insurance plan, unlike most insurance plans, offers pure and simple financial protection for loved ones in the event of the policyholder’s unfortunate demise. It is the most sought-after policy because of the low cost of the premium and also the high value of insurance coverage. Now you can buy LIC term insurance plan online Buy LIC Term Plan Online in an easy and hassle free-way with simple documentation & the premium rates are flexible in terms of payment.

The LIC term insurance plan LIC Term Plan Jeevan Amar also offers the flexibility of choosing the death benefit payout in regular installments of 5, 10, and 15 years. This feature guarantees that the family of the deceased has an income source during difficult times. This feature guarantees that the family of the deceased has an income source during the difficult times.