Buy LIC Pension Plan Online

Retirement is a significant milestone in everyone’s life, and being financially prepared for it is crucial. One way to secure a stable income source after retirement is by investing in a pension plan. LIC (Life Insurance Corporation), a trusted name in the insurance industry, offers several pension plans to cater to the diverse needs of individuals. If you are looking for the best pension plan that suits your requirements, buying a LIC pension plan online is the way to go.

LIC pension plans are considered to be the best in the market, providing individuals with a reliable income source after retirement. By investing in a pension plan by LIC, you can ensure a regular income during your retirement years and maintain your standard of living. These plans not only provide financial security but also offer various benefits such as tax exemption on the amount invested and a guaranteed sum assured. With LIC retirement plans online, you can easily compare different plans, calculate premiums, and choose the one that best aligns with your retirement goals and financial situation. Embrace the future with confidence by investing in a LIC pension plan online and securing a worry-free retirement.

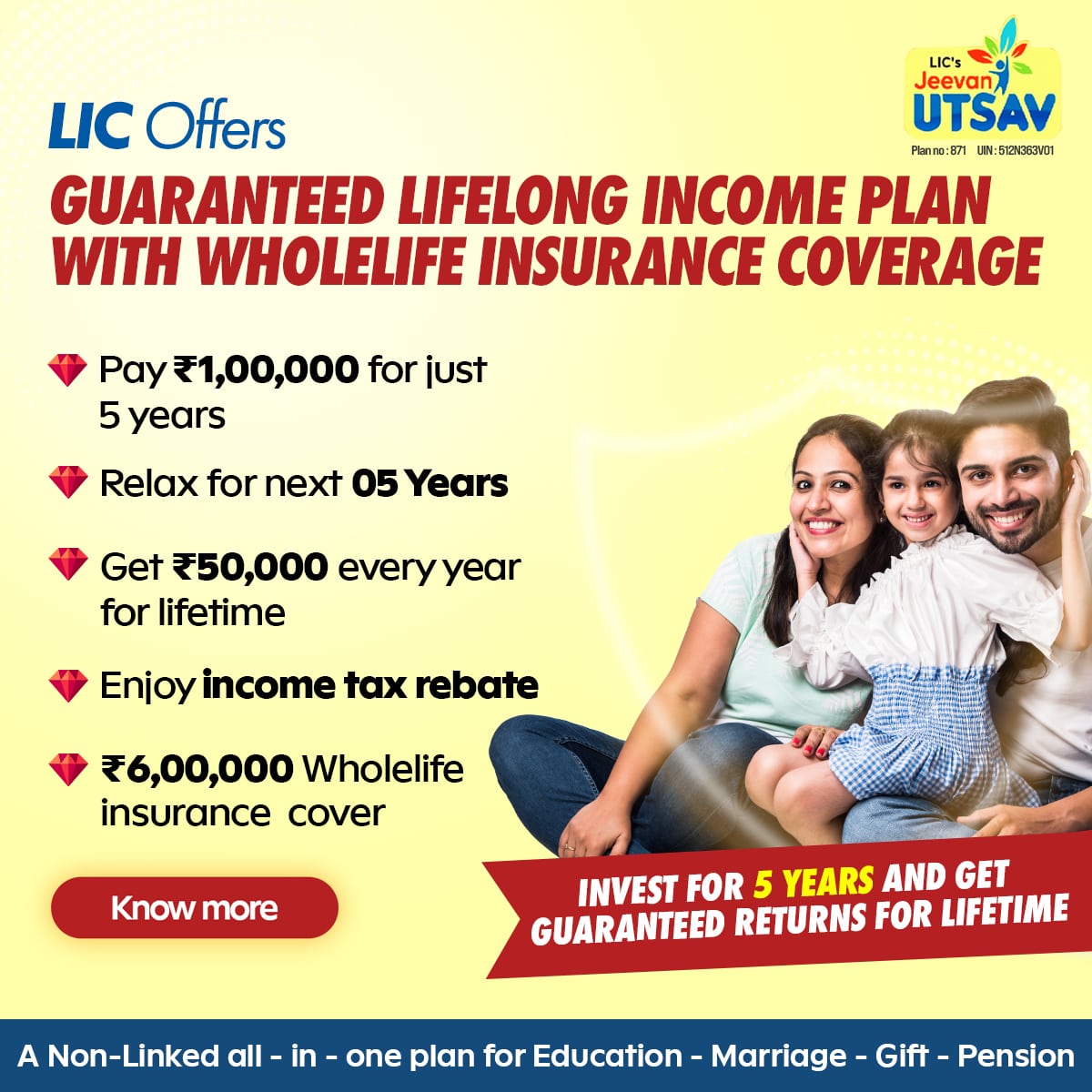

One such popular plan offered by LIC is the Jeevan Umang plan, which not only provides financial security but also offers survival benefits to policyholders. Additionally, the New Jeevan Shanti plan is designed to provide retirees with a stable income for the rest of their lives.

The LIC Pension Plan online guarantees a fixed amount of money to policyholders throughout their life, and after the policyholder’s death, a lump sum is paid to the insured. Investing in Pension Plans from LIC helps you secure your financial future and offers stable, enjoyable post-retirement years. LIC Pension Plan Online has come up with multiple LIC Pension Scheme choose LIC Best Pension Plan online today and secure your financial future after retirement.