Buy LIC Child Plan Online

As parents, we always want to ensure a secure future for our children. From their education to their overall well-being, we strive to provide them with the best opportunities in life. To cater to the needs of growing children, LIC (Life Insurance Corporation) offers a range of best child plans Buy LIC Policy Online for Child that can be conveniently purchased online. This allows you to plan for your child’s future from the comfort of your own home.

LIC Child Plan allows you to secure your child’s future and fulfill their aspirations without any financial burden. Offering the best policy for children LIC Jeevan Tarun Plan, this plan not only provides a comprehensive coverage but also guarantees premium returns. Additionally, LIC presents various options such as Jeevan Tarun Plan, LIC Jeevan Lakshya Plan, and LIC New Children Money Back Plan, enabling you to choose the best plan that suits your child’s needs and requirements.

The LIC Jeevan Lakshya plan Buy LIC Jeevan Lakshya Plan Online is a limited premium endowment plan that offers a combination of savings and protection, ensuring your child’s dreams are secured even in unforeseen circumstances. The LIC Jeevan Tarun plan LIC Jeevan Tarun Plan provides survival and death benefits for your child’s education. Even in unfortunate events, provide a regular stream of income to meet your child’s educational and career needs. Additionally, the New Children’s Money Back Plan LIC Child Education Plan offers periodic payouts to meet the child’s education, marriage, and other milestones.

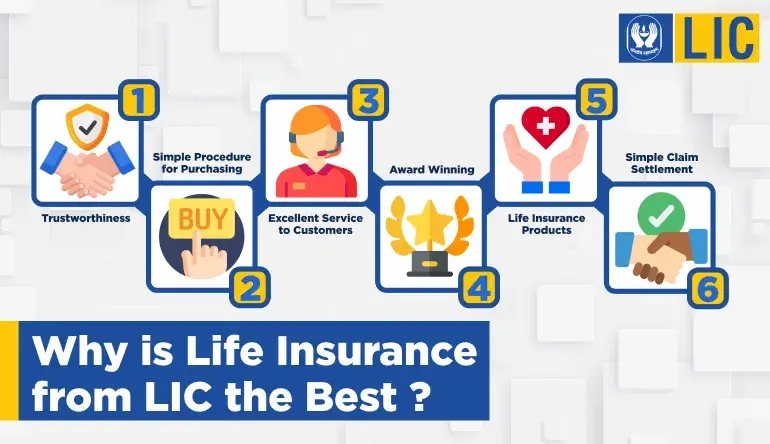

LIC, a top Indian insurer, offers a user-friendly online platform to buy the best child plan LIC Child Plan Online Purchase with convenience. Say goodbye to physical documentation and paperwork. Enjoy secure transactions and flexible premium payment options like cards and UPI. Choose LIC for hassle-free coverage for your children and convenient experience for policyholders, making transactions seamless and secure.

Investing in a LIC child plan not only secures your child’s future but also provides tax benefits. So why wait? Choose an LIC child plan today and give your child a head start in life.