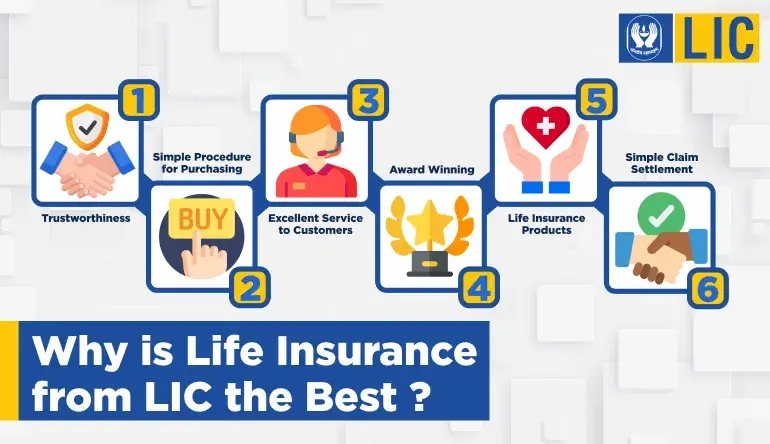

Buy LIC Tax Saving Plans Online

LIC Life insurance policies offer tax benefits! Why go through the hassle of reporting a large portion of your income for taxes when you can obtain an Income Tax exemption by purchasing a tax-saving LIC policy online? We can assist you in choosing the most suitable LIC Tax saving plans for you.

When it comes to tax savings, LIC Tax Saving Plans are among the most popular choices in India. These plans not only aid individuals in reducing their tax obligations but also provide them with financial security and long-term savings. With advancements in technology, buying these plans has become even more convenient as individuals now have the option to buy LIC Tax Saving Plans through the internet.

There are several popular tax saving LIC which lic policy is best for tax benefit that can be purchased online. One such plan is the LIC New Endowment Plan lic new endowment plan benefits , which offers both protection and savings benefits. Another popular option is the LIC New Jeevan Anand Policy, which not only provides life cover but also offers maturity benefits. The LIC New Jeevan Labh Policy best lic policy for tax benefit is another sought-after plan that provides guaranteed additions and a flexible maturity term.

Additionally, individuals can also consider the LIC New Jeevan Umang Plan popular lic tax saving plans , which provides a combination of protection and savings along with a regular income. For those looking for a plan with a specific goal in mind, the LIC New Jeevan Lakshya Plan is a great choice as it provides financial assistance for the child’s education or marriage.